Why Argentina Needs Bailout After Bailout After Bailout

NegativeFinancial Markets

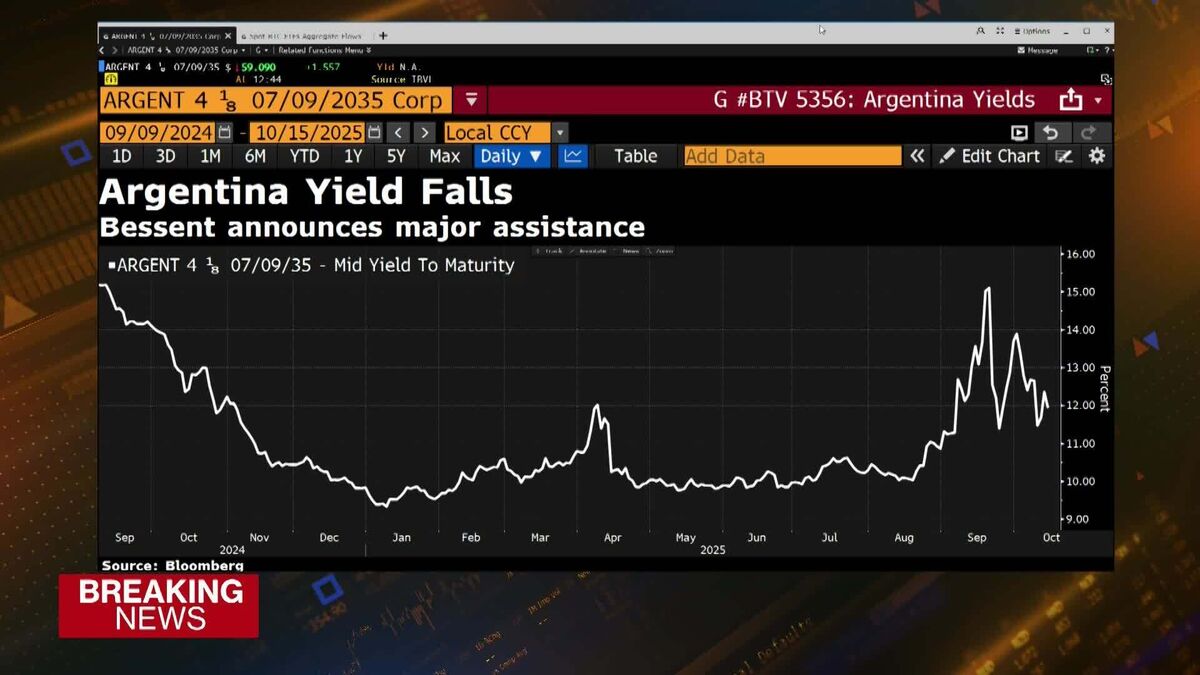

Argentina's ongoing struggle with economic instability has led to a series of bailouts, raising concerns about the sustainability of its financial practices. The country's reliance on international assistance, particularly from the IMF, highlights the challenges it faces in managing its debt and restoring investor confidence. This situation matters because it not only affects Argentina's economy but also has broader implications for global markets and the future of international financial support.

— Curated by the World Pulse Now AI Editorial System