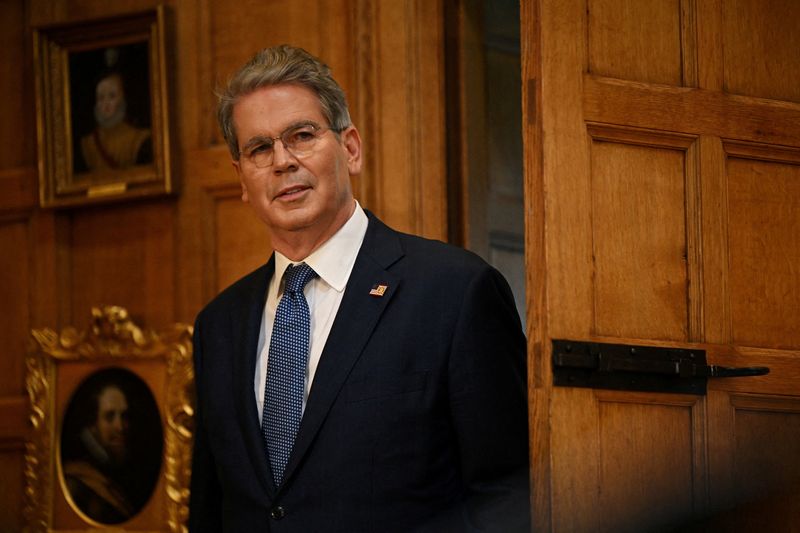

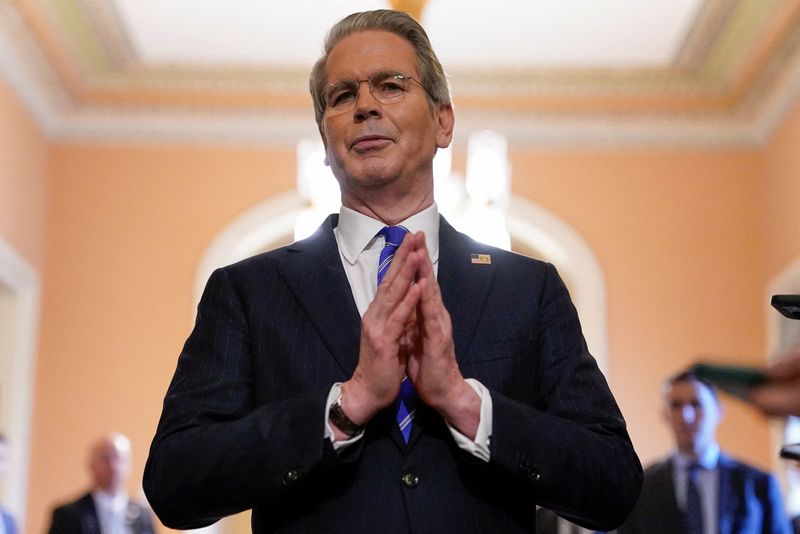

Bessent says IMF should stick to core mission, could sell Maryland golf course

NeutralFinancial Markets

Bessent has emphasized that the International Monetary Fund (IMF) should remain focused on its core mission, which is crucial for global economic stability. Additionally, he mentioned the possibility of selling a golf course in Maryland, indicating a potential shift in asset management. This is significant as it reflects the IMF's ongoing efforts to streamline operations and prioritize its primary objectives.

— Curated by the World Pulse Now AI Editorial System