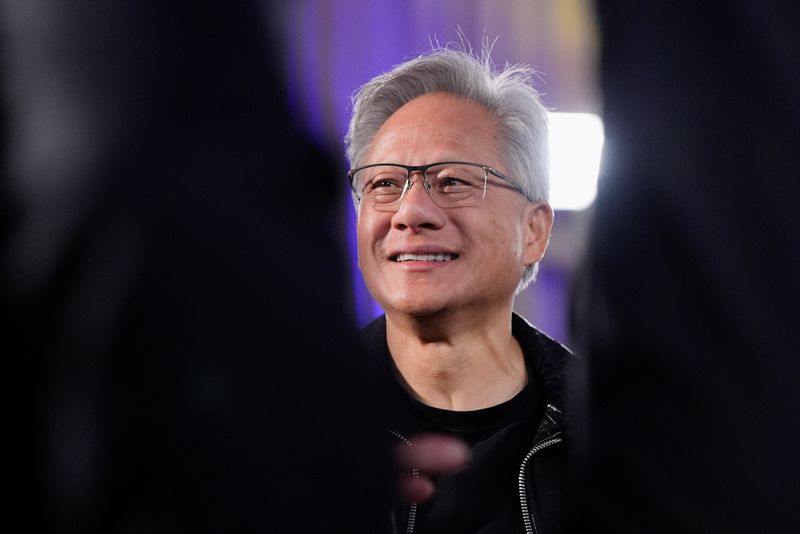

Nvidia to continue sponsoring H-1B visas, Business Insider reports

PositiveFinancial Markets

Nvidia has announced its commitment to continue sponsoring H-1B visas, a move that highlights the company's dedication to attracting global talent. This decision is significant as it not only supports skilled professionals seeking opportunities in the U.S. but also reinforces Nvidia's position as a leader in the tech industry. By investing in diverse talent, Nvidia aims to foster innovation and maintain its competitive edge in a rapidly evolving market.

— Curated by the World Pulse Now AI Editorial System