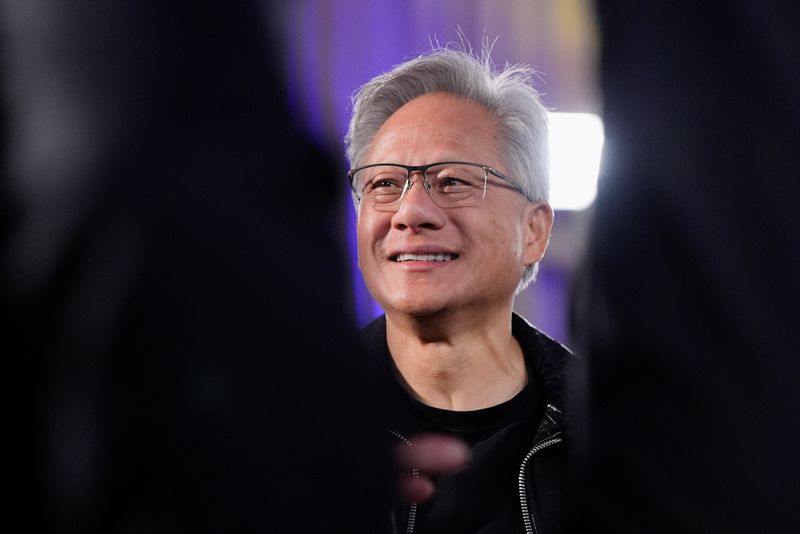

Top analyst ‘very concerned’ about Nvidia fueling an AI bubble and a ‘Cisco moment’ like the dotcom crash: ‘We’re a lot closer to the seventh inning than the first or second inning’

NegativeFinancial Markets

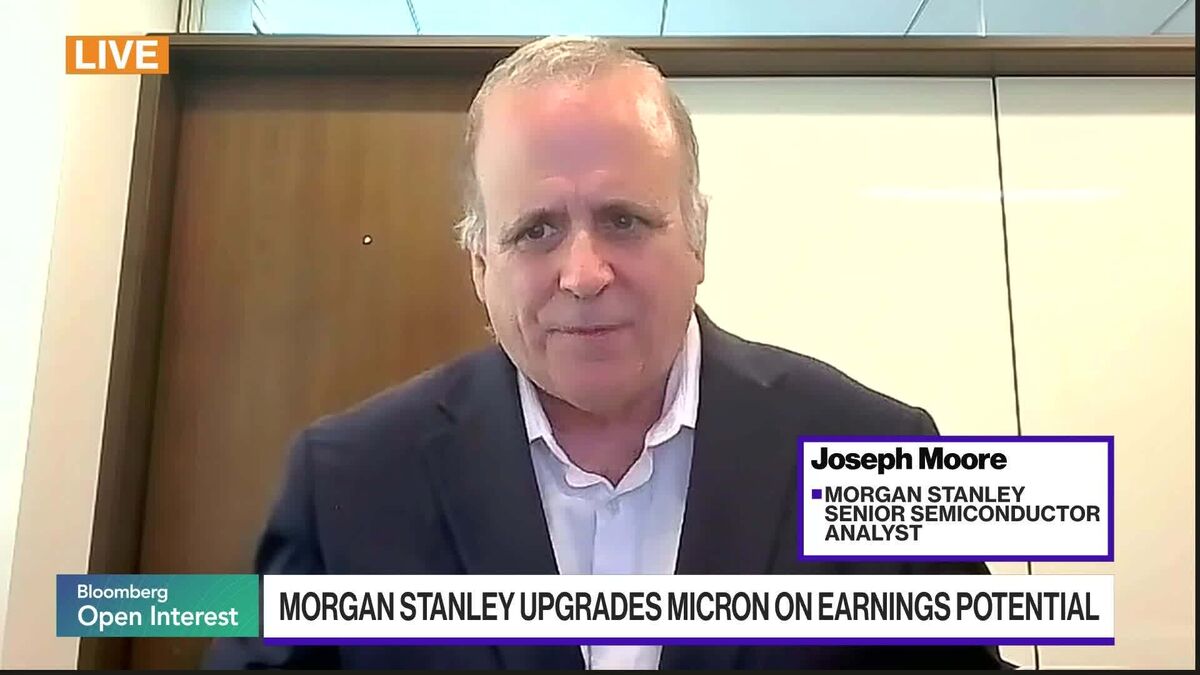

Morgan Stanley's Lisa Shalett has expressed serious concerns about Nvidia potentially driving an AI bubble, likening the situation to a 'Cisco moment' reminiscent of the dotcom crash. She suggests that we may be nearing the end of this cycle rather than the beginning, which raises alarms for investors and tech enthusiasts alike. This perspective is crucial as it highlights the risks associated with rapid advancements in AI technology and the potential for a market correction.

— Curated by the World Pulse Now AI Editorial System