Crypto Plunge Adds to Angst as Markets Extend Broad Retreat

NegativeFinancial Markets

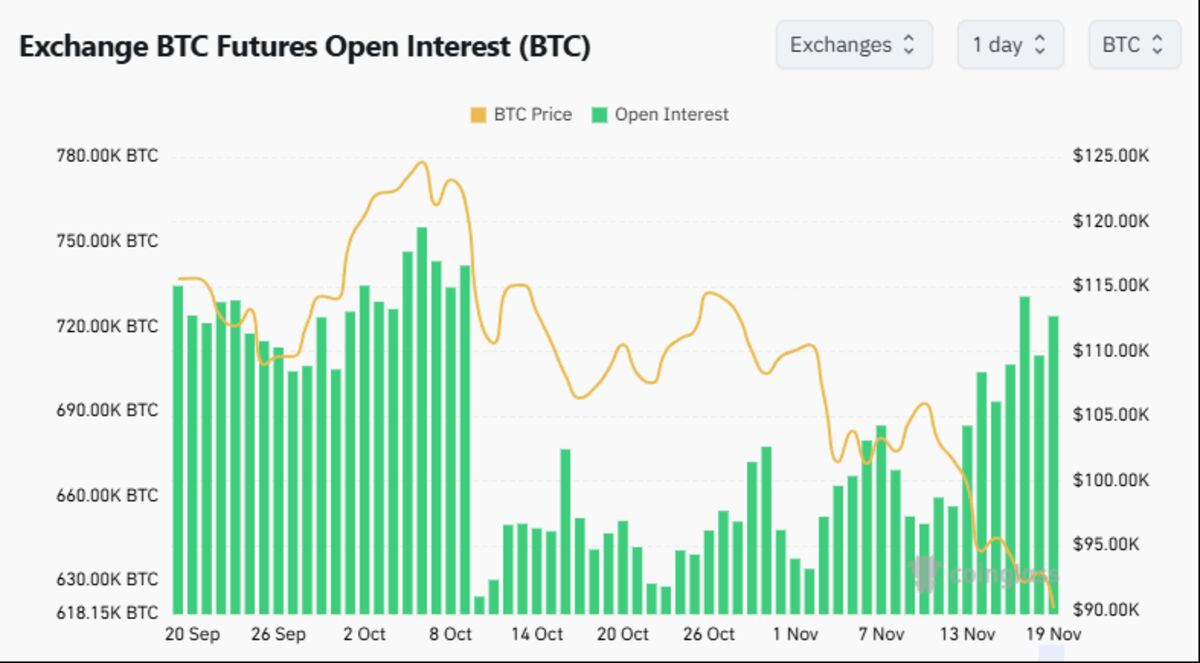

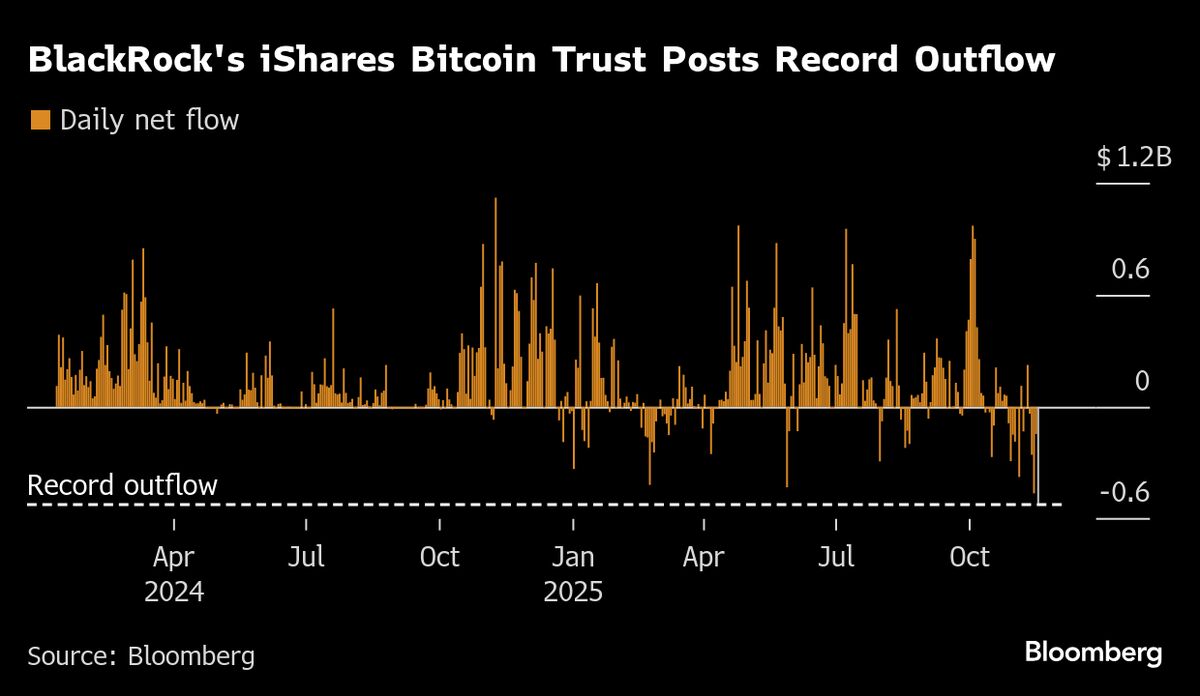

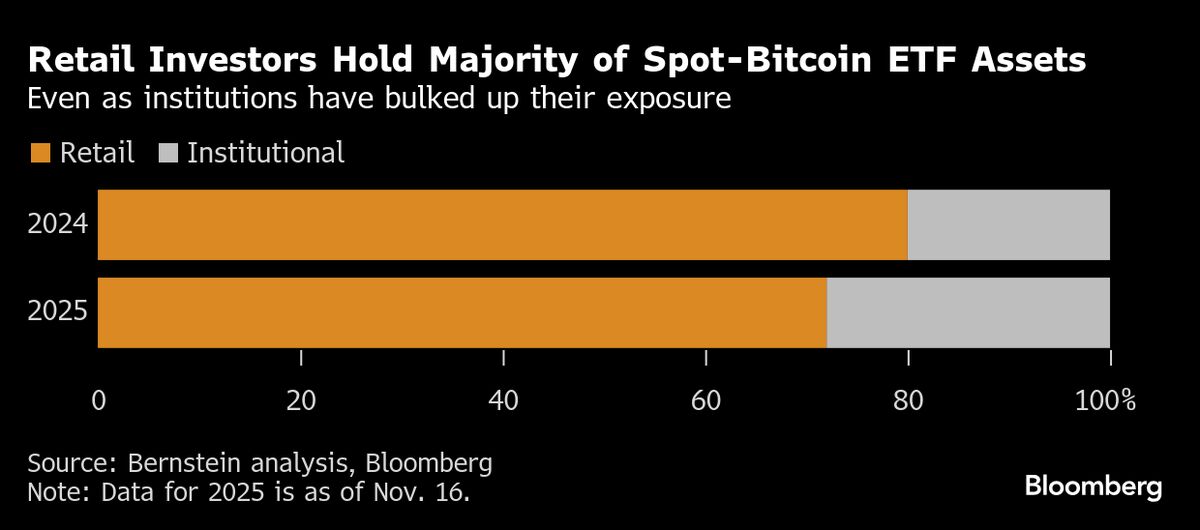

- Bitcoin's recent drop below $90,000 has intensified a broader retreat in global financial markets, leading to increased anxiety among investors. The decline raises concerns about the potential for leveraged investors to initiate a selling spiral, further impacting market stability.

- This development is significant as it underscores the interconnectedness of cryptocurrency and traditional financial markets. A sustained downturn could lead to increased volatility, affecting investor sentiment and potentially resulting in a more extensive market correction.

— via World Pulse Now AI Editorial System