Bitcoin Slide Spurs Record Withdrawals From BlackRock’s IBIT

NegativeFinancial Markets

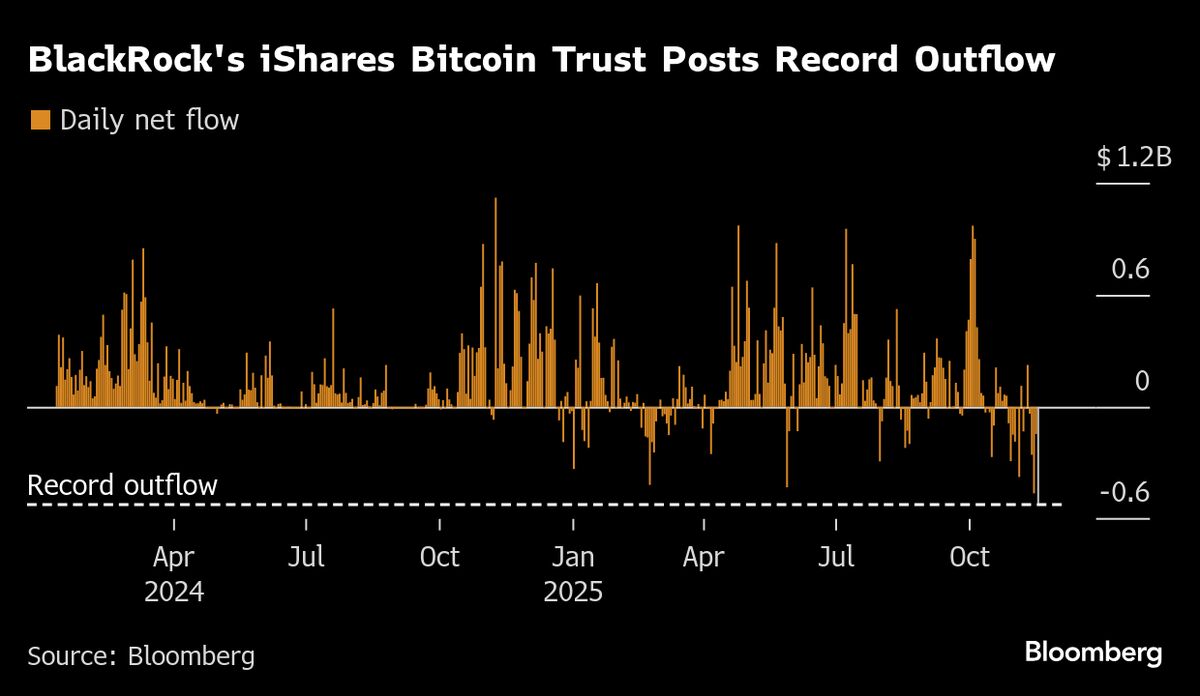

- Investors have pulled more than $500 million from BlackRock's iShares Bitcoin Trust, indicating a severe downturn in confidence in the cryptocurrency market. This outflow represents the largest single-day withdrawal since the fund's launch.

- The record withdrawals from the iShares Bitcoin Trust highlight the challenges BlackRock faces in maintaining investor trust amid a turbulent market environment, where Bitcoin has seen significant price declines.

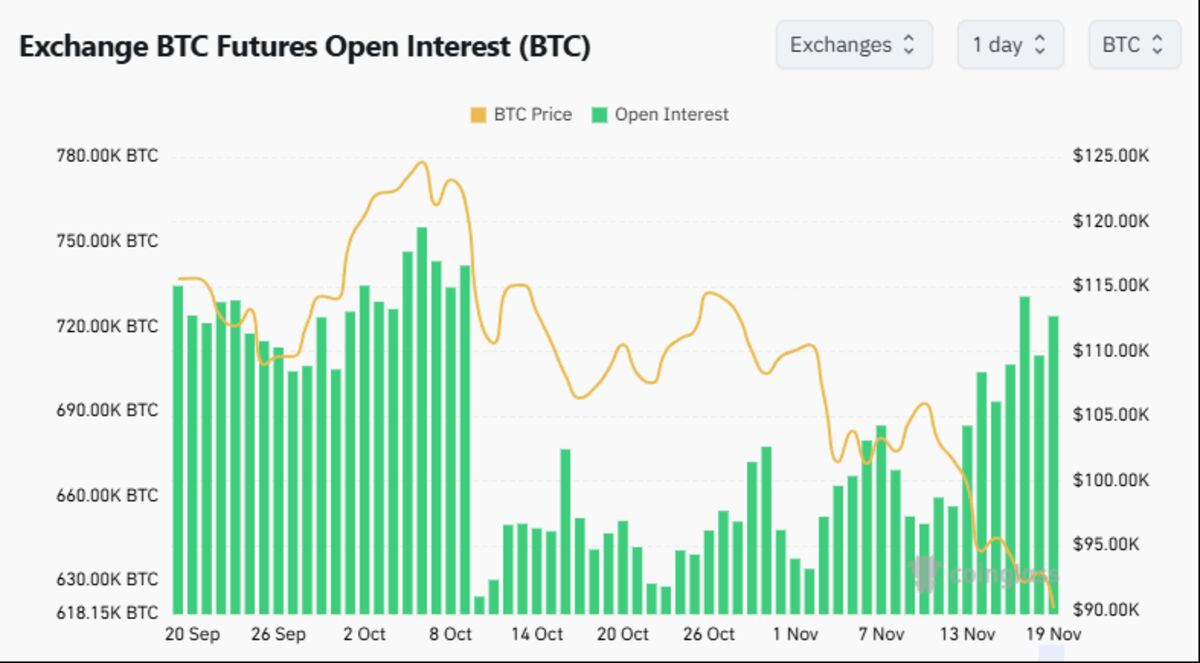

- The broader cryptocurrency market is experiencing a substantial downturn, with Bitcoin's value dropping nearly 30% from its peak earlier in 2025, contributing to a loss of $1.2 trillion across the sector as traders move away from speculative assets.

— via World Pulse Now AI Editorial System