Retail Traders Schooled on Market Timing as New Crypto Bets Sink

NegativeFinancial Markets

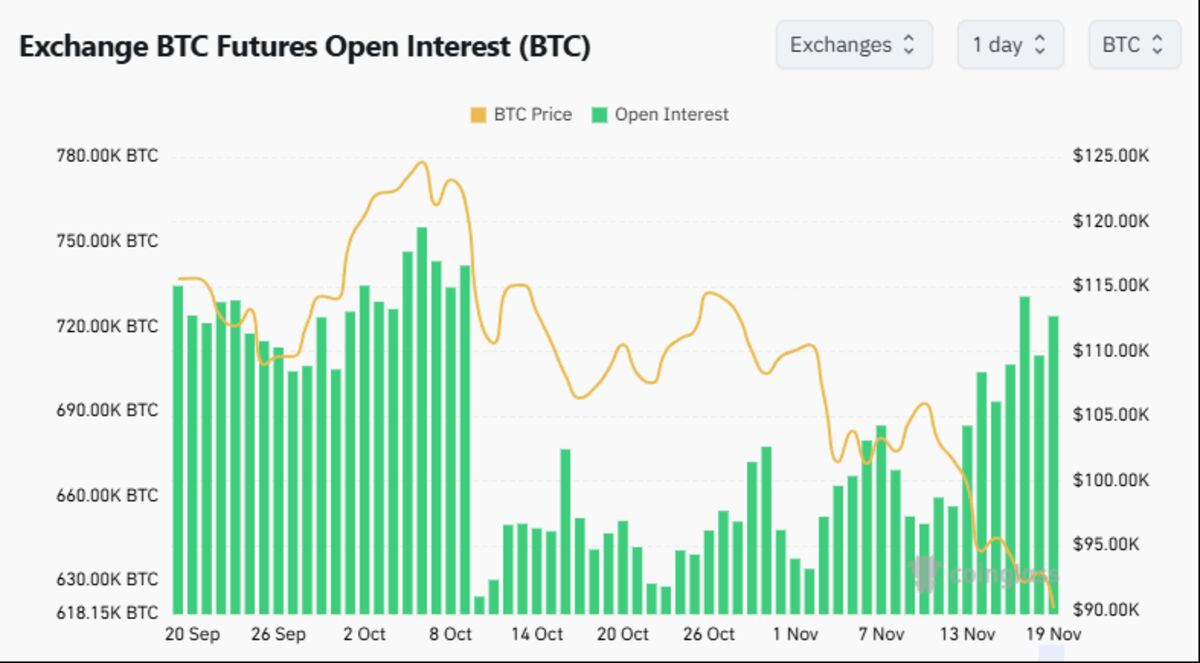

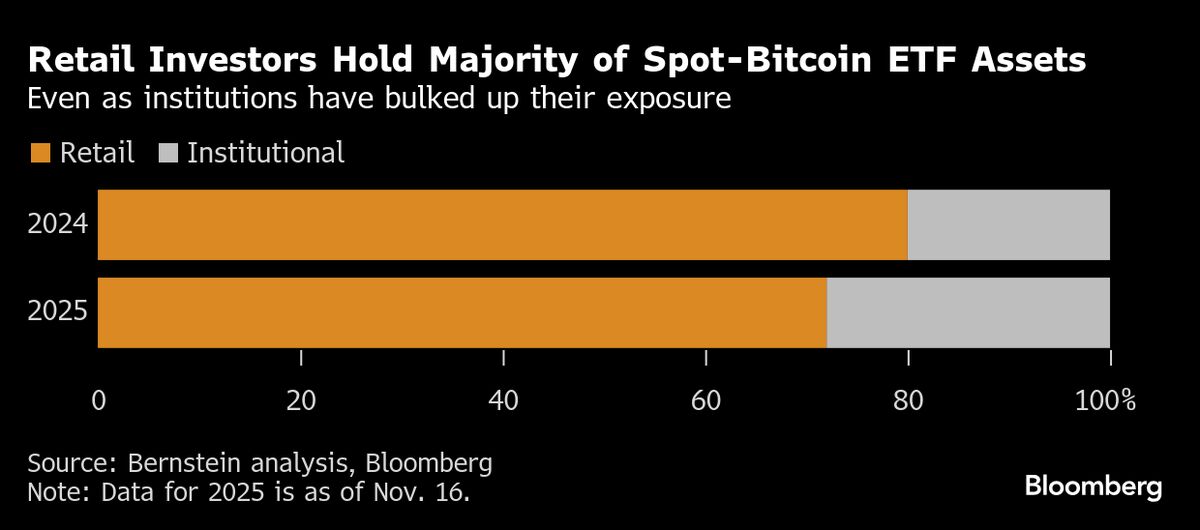

- Wall Street's recent foray into cryptocurrency ETFs has backfired, with all 11 new funds tied to smaller cryptocurrencies showing losses amid a significant market selloff. Bitcoin's market value has plummeted by around $600 billion since its October peak, raising concerns about the sustainability of crypto investments.

- This situation underscores the volatility of the cryptocurrency market and the risks associated with speculative investments. Retail traders are now facing challenges in timing their market entries effectively.

- The broader market sentiment is increasingly negative, with fears of further declines as Bitcoin struggles to maintain its value. This trend reflects a growing aversion to risk among investors, particularly in light of recent declines in tech stocks and other speculative assets.

— via World Pulse Now AI Editorial System