What ‘Emerging Market’ Status Would Mean for Vietnam

PositiveFinancial Markets

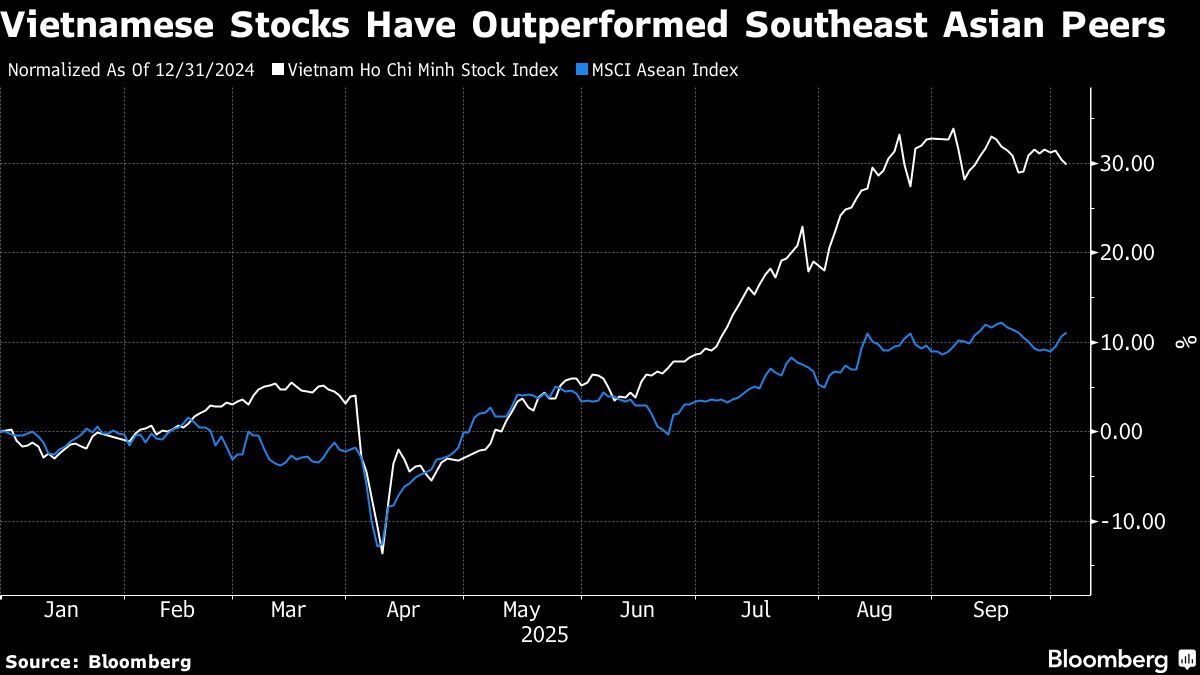

FTSE Russell's decision to upgrade Vietnam from a 'frontier' to an 'emerging' market is a significant milestone for the country. This change is expected to attract more foreign investment and boost the economy, as it enhances Vietnam's global standing and opens up new opportunities for growth. Investors and businesses alike are likely to benefit from this upgrade, making it an exciting time for Vietnam's financial landscape.

— Curated by the World Pulse Now AI Editorial System