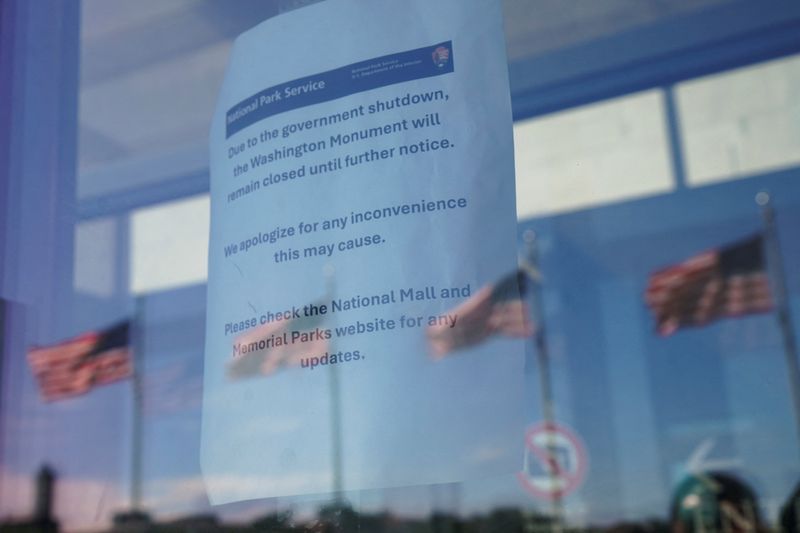

TD Bank activates TD Cares program for federal workers amid shutdown

PositiveFinancial Markets

TD Bank has launched its TD Cares program to support federal workers affected by the government shutdown. This initiative is crucial as it provides financial relief and resources to those facing uncertainty during this challenging time. By stepping up to assist these workers, TD Bank demonstrates its commitment to community support and financial well-being, making a positive impact on the lives of many.

— Curated by the World Pulse Now AI Editorial System