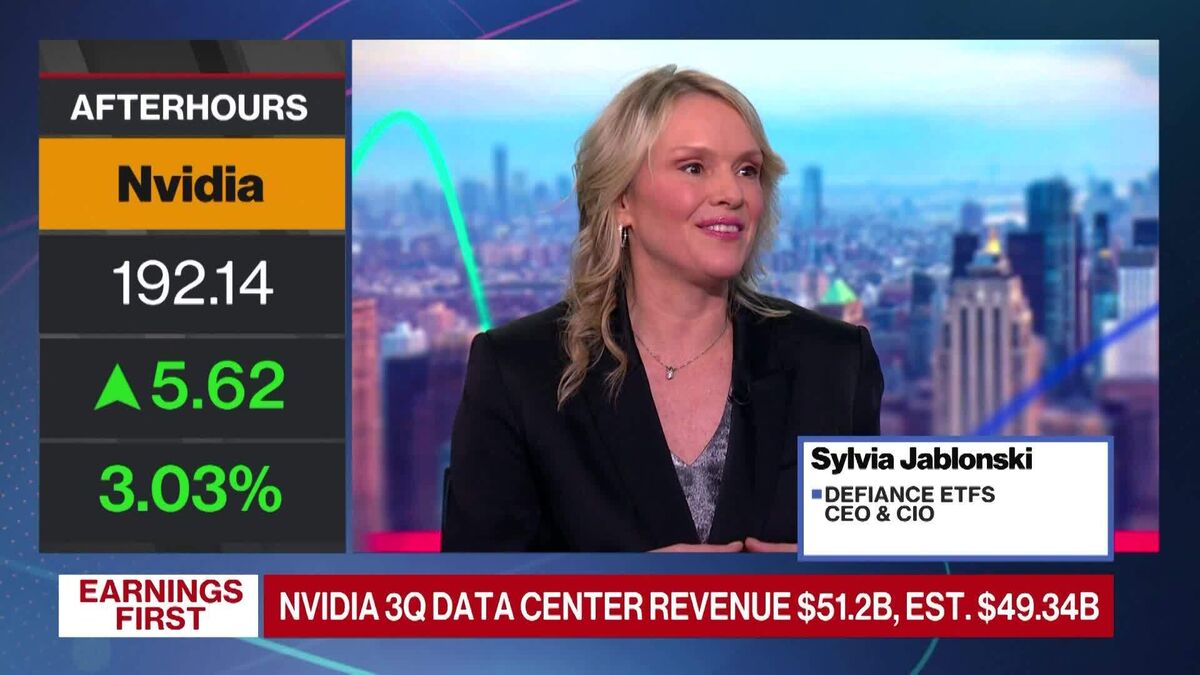

Nvidia Results and Delayed Jobs Data Set Up Critical Test for Wall Street

NeutralFinancial Markets

- Nvidia's earnings report is anticipated to provide key insights into the company's performance and the sustainability of the AI boom, following a significant market pullback. Investors are keenly awaiting these results as they could set the tone for future market movements.

- The importance of Nvidia's performance cannot be overstated, as it plays a pivotal role in the AI sector, and its results will likely impact investor confidence and market dynamics. A strong performance could bolster the tech sector, while a miss may heighten concerns.

- The current market environment reflects a cautious sentiment, with broader indices experiencing declines amid fears of an AI bubble. Investors are grappling with uncertainty, as Nvidia's results could either reinforce or challenge the prevailing optimism surrounding technology stocks.

— via World Pulse Now AI Editorial System