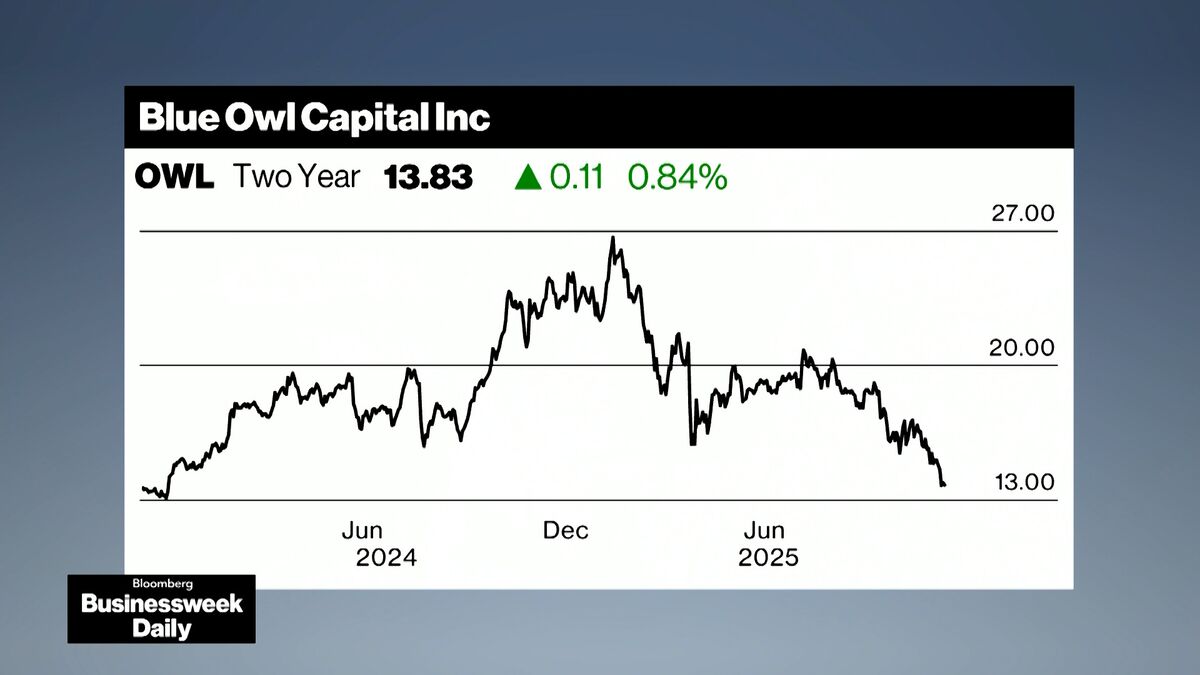

Blue Owl Money Machine Sputters in Face of Private Credit Cracks

NegativeFinancial Markets

- Blue Owl Capital Inc. has scrapped its merger of two private credit funds following scrutiny over potential investor losses, prompting a search for liquidity solutions.

- This cancellation is significant as it reflects the company's response to investor concerns and the pressures within the private credit market, which have negatively impacted its shares.

- The broader context reveals a trend of increasing scrutiny in the private credit industry, with regulators and investors alike raising alarms about the adequacy of protections for investors amid market volatility.

— via World Pulse Now AI Editorial System