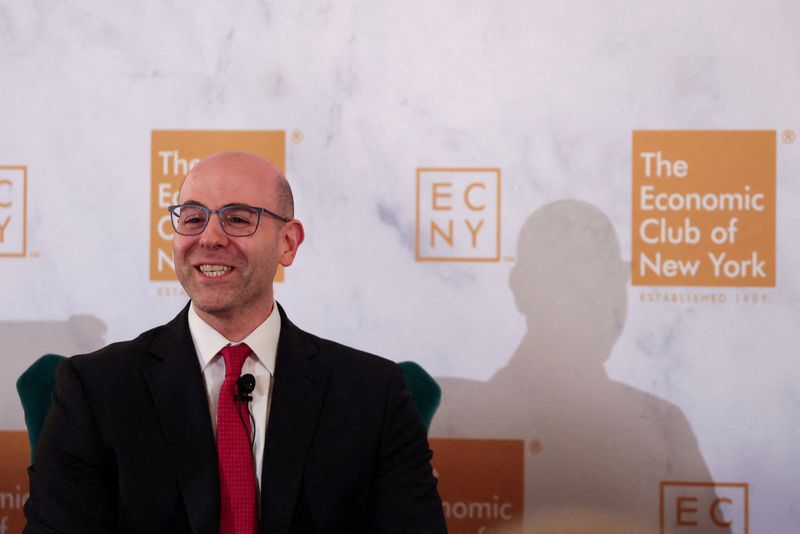

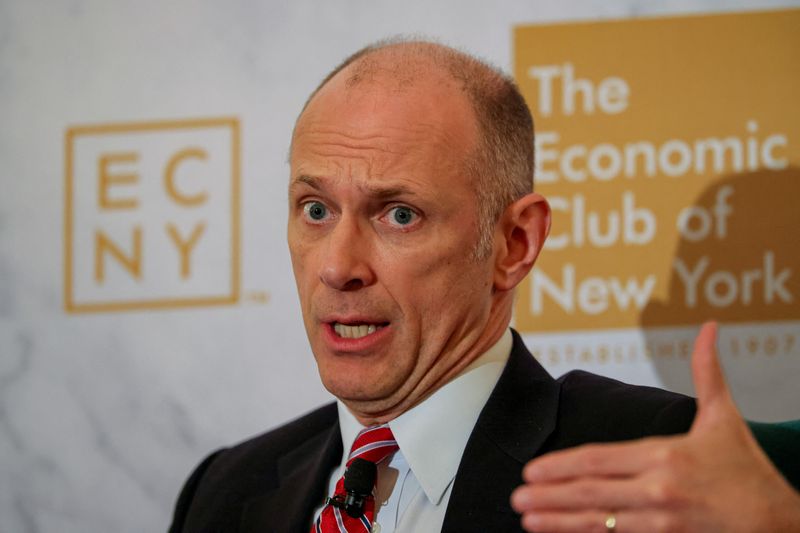

Fed’s Cook signals December rate cut is not a foregone conclusion

NeutralFinancial Markets

Federal Reserve Governor Lisa Cook recently addressed the possibility of a rate cut in December, indicating that it is not a certainty. This is her first public statement since former President Donald Trump attempted to remove her from her position. Cook's remarks are significant as they reflect the central bank's cautious approach to monetary policy amidst ongoing economic uncertainties, which could impact markets and borrowing costs.

— Curated by the World Pulse Now AI Editorial System