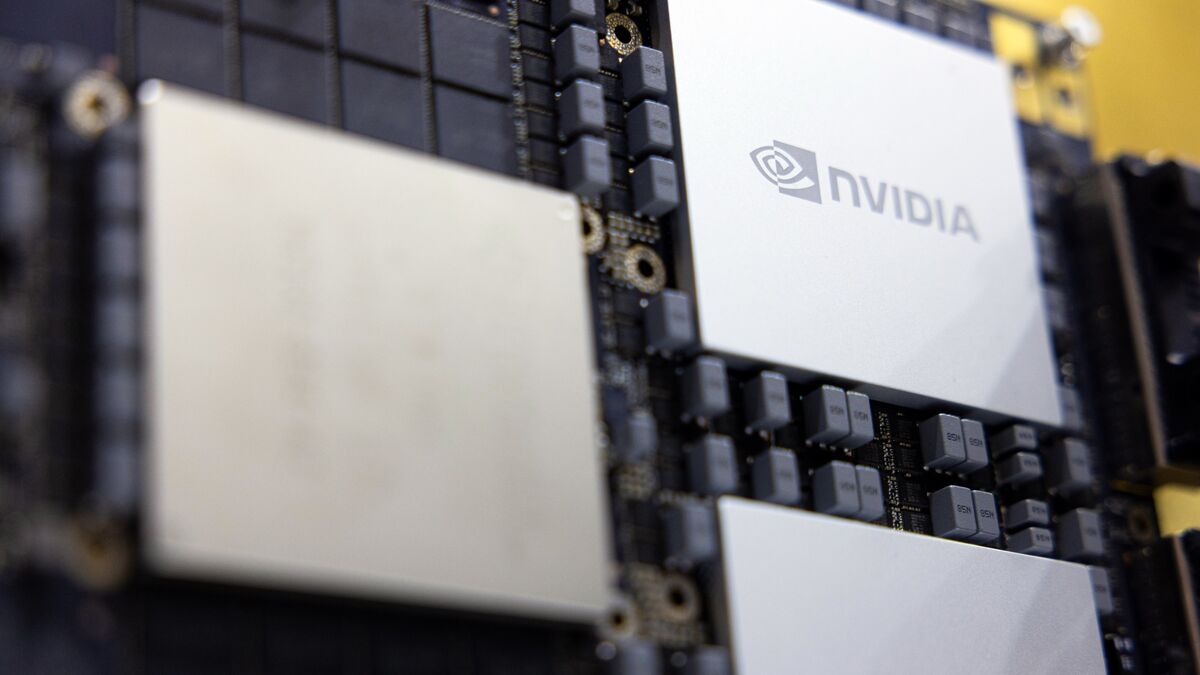

Nvidia’s Stock Is Sinking as Doubts About Its AI Dominance Grow

NegativeFinancial Markets

- Nvidia Corp. is experiencing a decline in its stock value amid growing skepticism regarding its dominance in the artificial intelligence semiconductor market. Despite reporting strong earnings that exceeded Wall Street's expectations, investor concerns about a potential bubble in AI stocks persist, leading to a negative sentiment in the market.

- This situation is critical for Nvidia as it navigates a competitive landscape where its market leadership is being challenged. The company's ability to maintain investor confidence is essential, especially as it faces increasing competition from other tech giants like Alphabet Inc. and potential shifts in market dynamics.

- The broader market context reveals a complex interplay between investor optimism and caution, as some analysts express concerns about excessive hype surrounding Nvidia. While some reports indicate a positive outlook for AI-related valuations, the ongoing debates about sustainability and competition highlight the volatility and uncertainty in the tech sector.

— via World Pulse Now AI Editorial System