Gold’s Spectacular Three-Year Rally Is Breaking All the Records

PositiveFinancial Markets

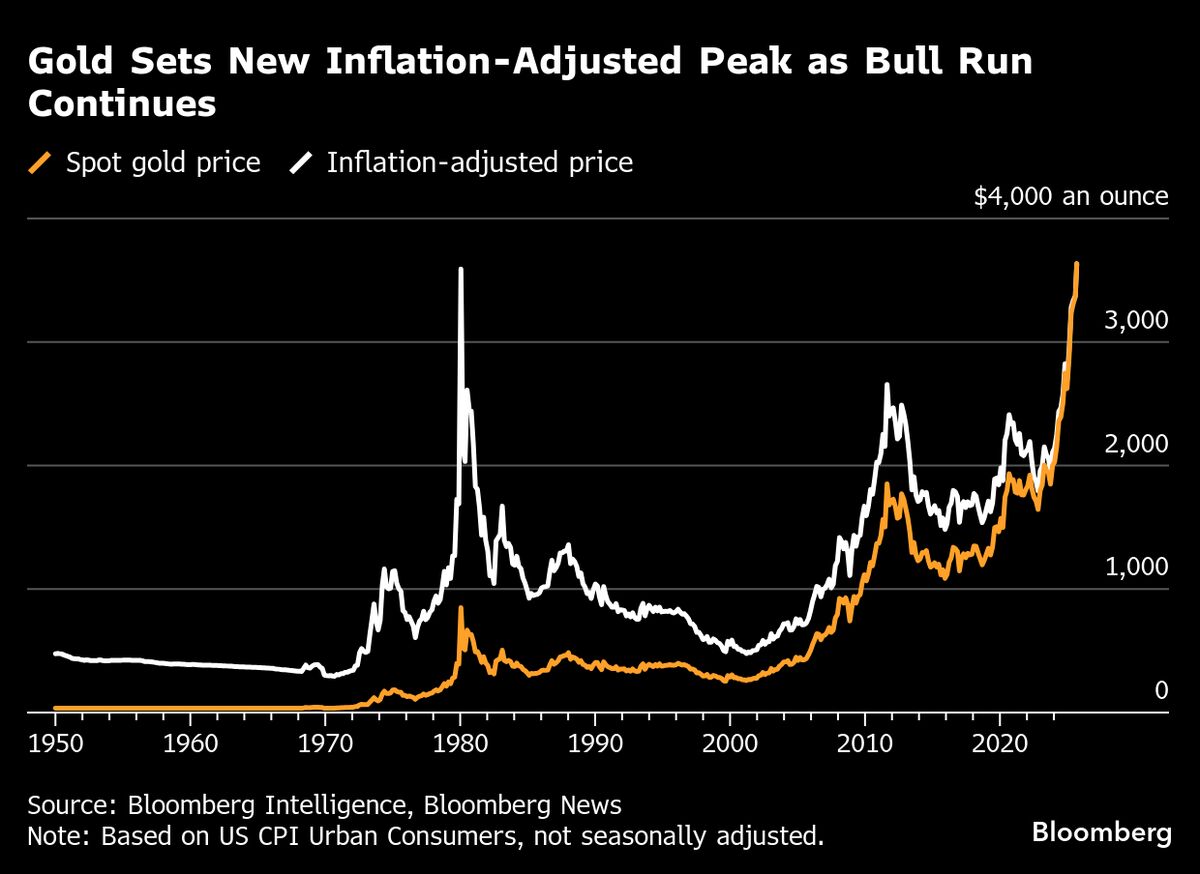

Gold has reached an impressive milestone, surpassing $4,000 an ounce, marking a significant achievement in its three-year bull run. This rally has not only surprised skeptics but has also challenged traditional analytical models that have long predicted its price movements. This development is crucial as it reflects growing investor confidence and could influence market trends moving forward.

— Curated by the World Pulse Now AI Editorial System