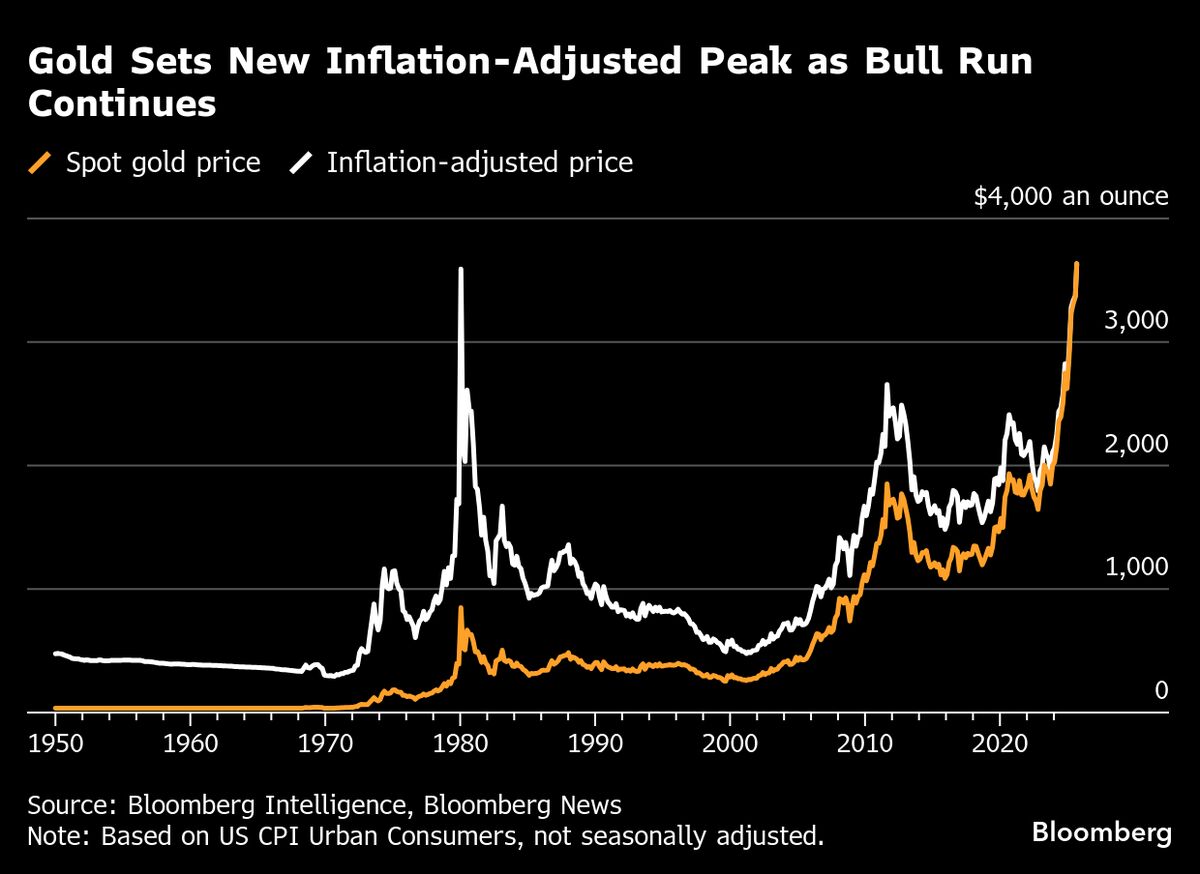

Gold Tops $4,000 for First Time as US Shutdown Fuels Rally

PositiveFinancial Markets

Gold has reached a historic milestone, surpassing $4,000 an ounce for the first time, driven by concerns over the US economy and a potential government shutdown. This surge is significant as it highlights gold's resilience and appeal as a safe-haven asset, especially given its price was below $2,000 just two years ago. With returns far exceeding those of equities this century, this rally reflects growing investor anxiety about global trade and economic stability, making gold a focal point in financial discussions.

— Curated by the World Pulse Now AI Editorial System