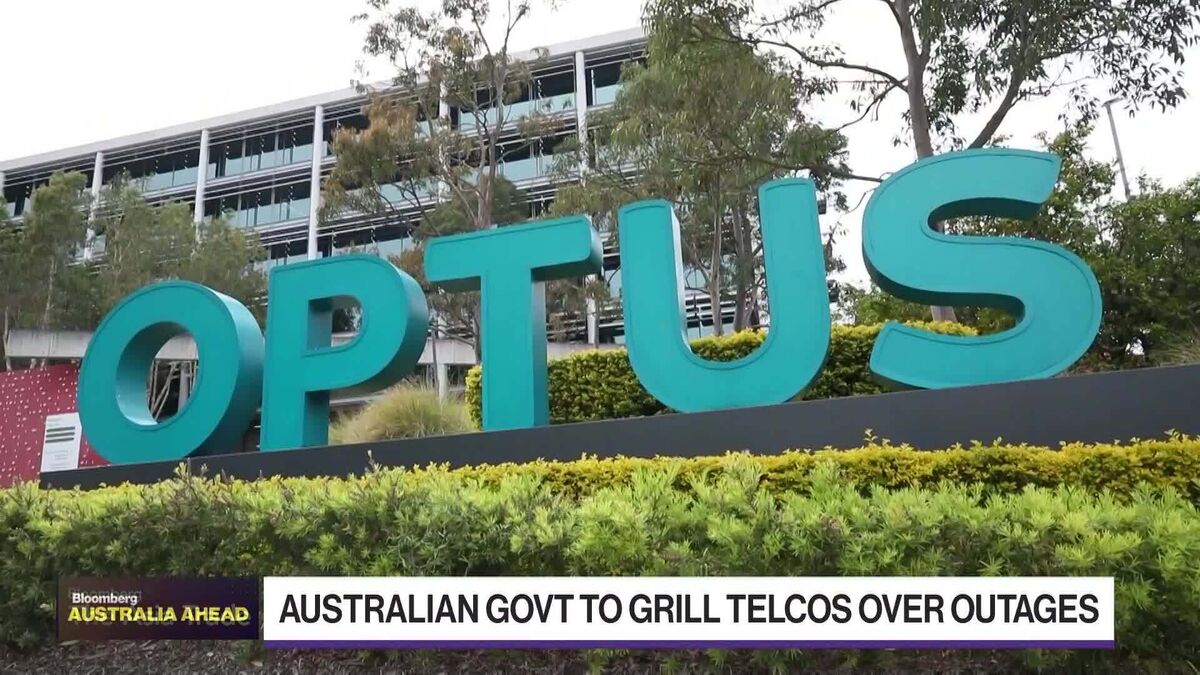

What Needs to Change After Australia's 000 Outages

NegativeFinancial Markets

Australia's communications minister is taking action after a troubling series of outages, including failures in the emergency 000 call system managed by Optus. This situation has raised significant concerns about the reliability of mobile networks in the country. Helen Bird from Swinburne University emphasizes the need for reforms in oversight and transparency within the telecommunications sector. This is crucial not only for improving service reliability but also for ensuring public safety, as these outages can have serious consequences during emergencies.

— Curated by the World Pulse Now AI Editorial System