Crypto market sheds $1.2tn as traders shun speculative assets

NegativeFinancial Markets

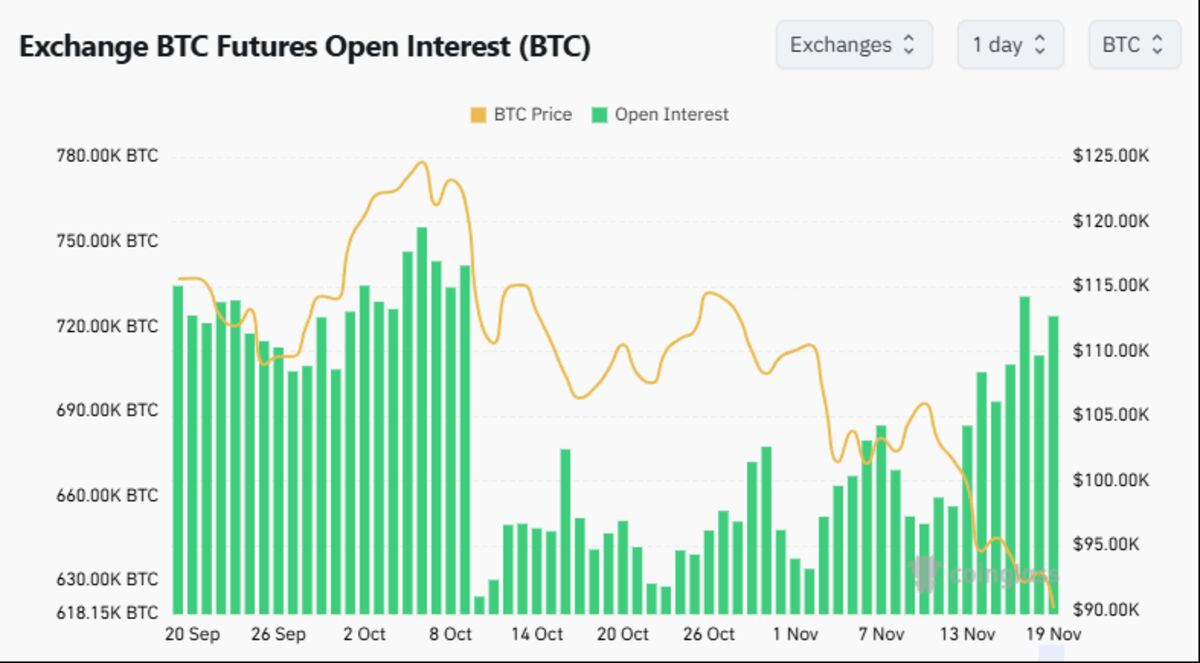

- The cryptocurrency market has lost $1.2 trillion as Bitcoin's price fell by 28% in six weeks, reflecting a broader decline in digital assets and Asian equities. This downturn has raised alarms among investors about the sustainability of speculative investments, leading to a cautious market environment.

- The decline in Bitcoin's value, now below $90,000, has intensified fears of a broader market selloff, particularly among leveraged investors. This situation underscores the fragility of market confidence and the potential for further declines in both cryptocurrencies and traditional markets.

- The current market conditions highlight a growing trend of risk aversion among investors, as evidenced by the mixed responses in stock futures and Bitcoin prices. While some indicators suggest a potential easing of losses, the overall sentiment remains negative, reflecting ongoing concerns about economic stability and the interconnectedness of global financial markets.

— via World Pulse Now AI Editorial System