Nvidia CEO Huang’s Outing Heats Up Korea’s Fried Chicken Stocks

PositiveFinancial Markets

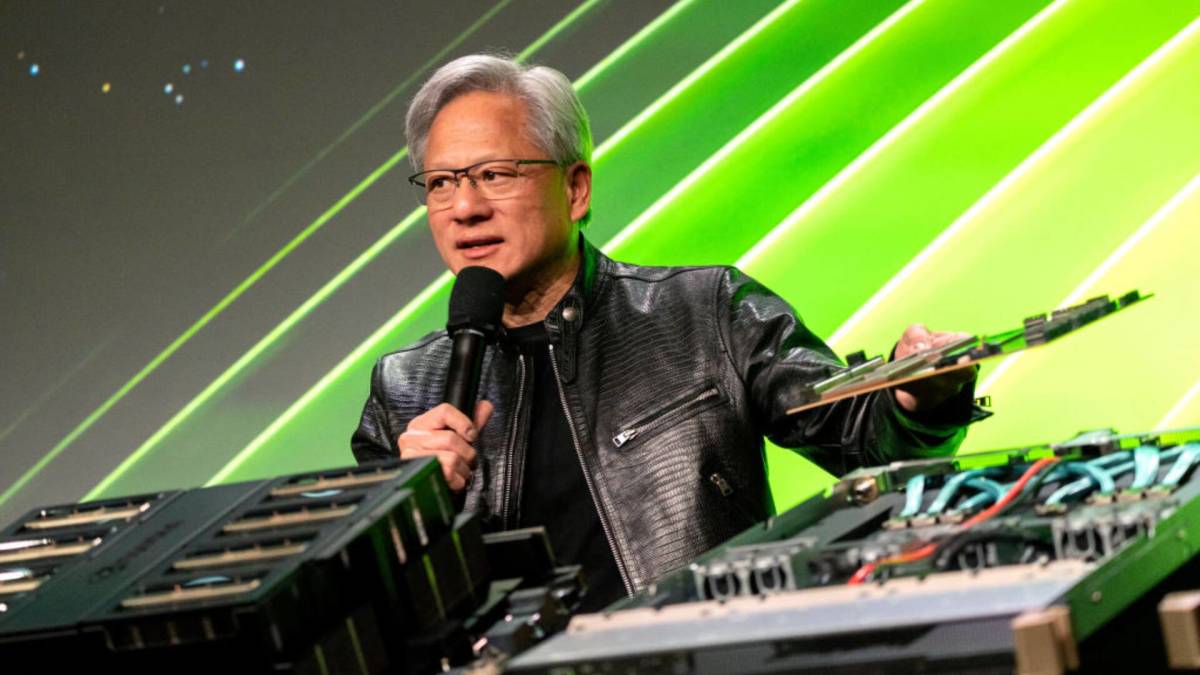

Nvidia CEO Jensen Huang's recent viral meal has sparked a significant surge in Korea's fried chicken stocks, highlighting the intersection of tech and food culture. This unexpected boost not only reflects the popularity of Huang but also showcases how social media can influence market trends, making it a noteworthy event for investors and food enthusiasts alike.

— Curated by the World Pulse Now AI Editorial System