Opinion | Tricolor and Treasury’s Seal of Approval

NegativeFinancial Markets

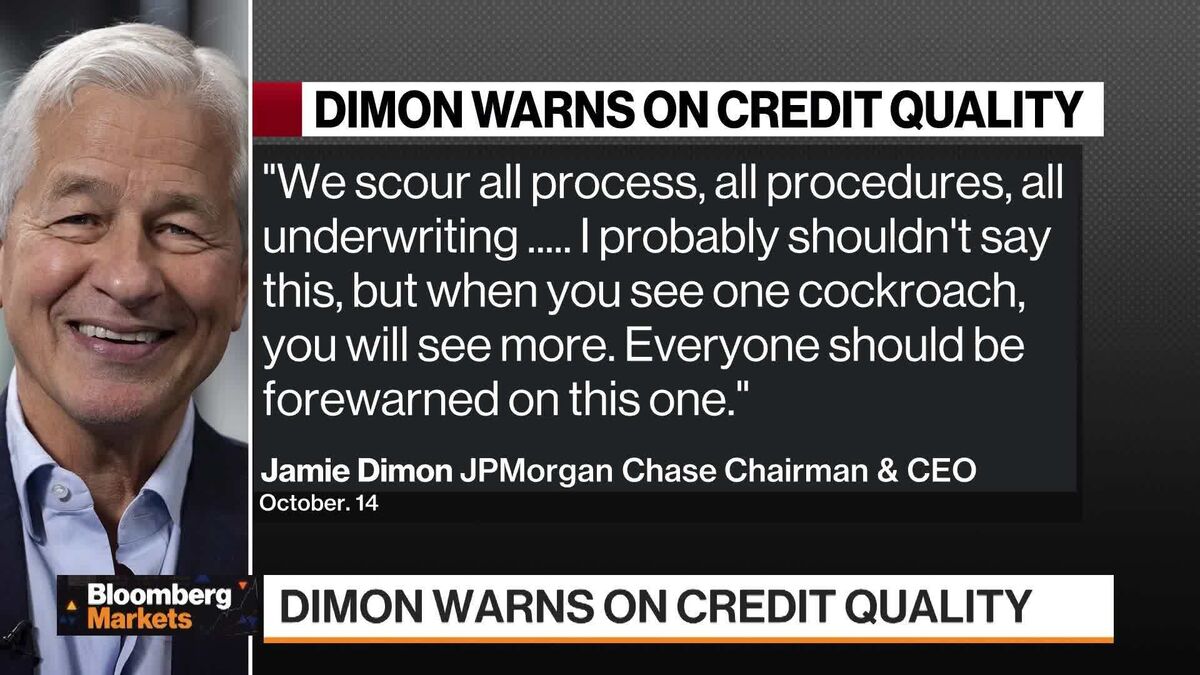

The recent opinion piece raises concerns about whether a political endorsement from the federal government may have led lenders to overlook critical due diligence when dealing with the now-failed subprime auto lender, Tricolor. This situation highlights the potential risks of government involvement in private lending practices and serves as a cautionary tale for future financial oversight.

— Curated by the World Pulse Now AI Editorial System