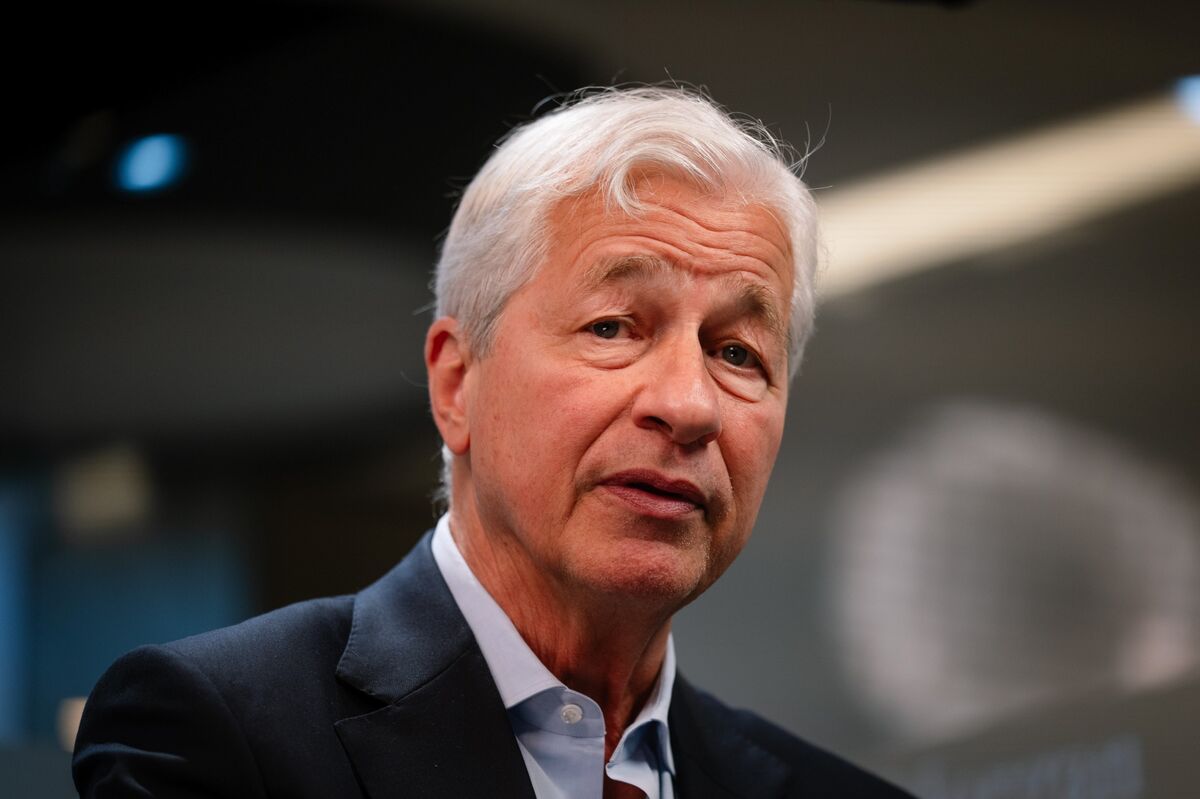

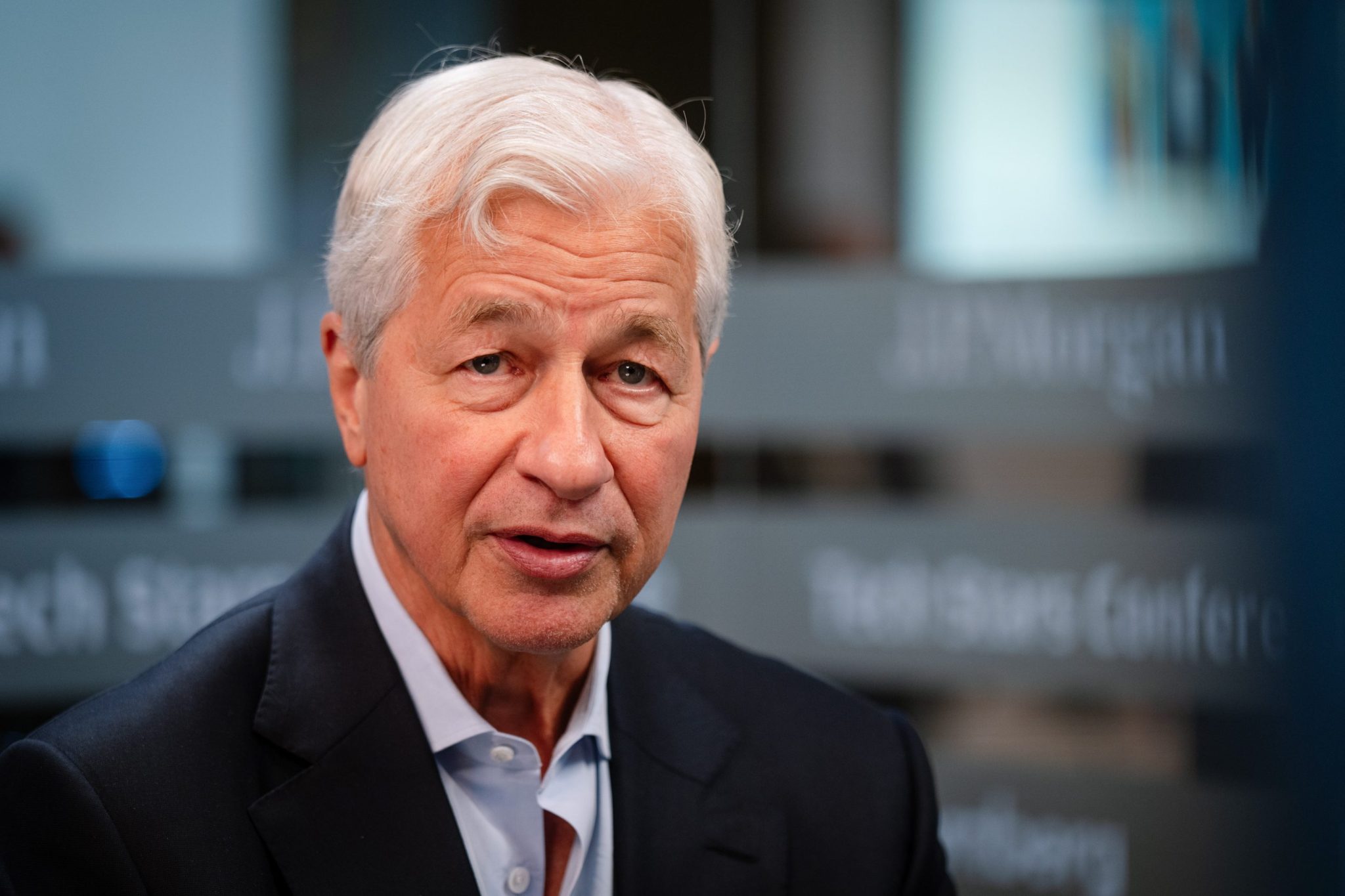

First Brands, Tricolor collapses raise fears of credit stress, with Dimon warning of ’more cockroaches’

NegativeFinancial Markets

The recent collapses of First Brands and Tricolor have raised significant concerns about potential credit stress in the market. Jamie Dimon, CEO of JPMorgan, has warned that these events could be indicative of deeper issues, likening them to 'more cockroaches' that may emerge as the financial landscape shifts. This situation is crucial as it highlights vulnerabilities in the credit markets, which could impact lending and economic stability.

— Curated by the World Pulse Now AI Editorial System