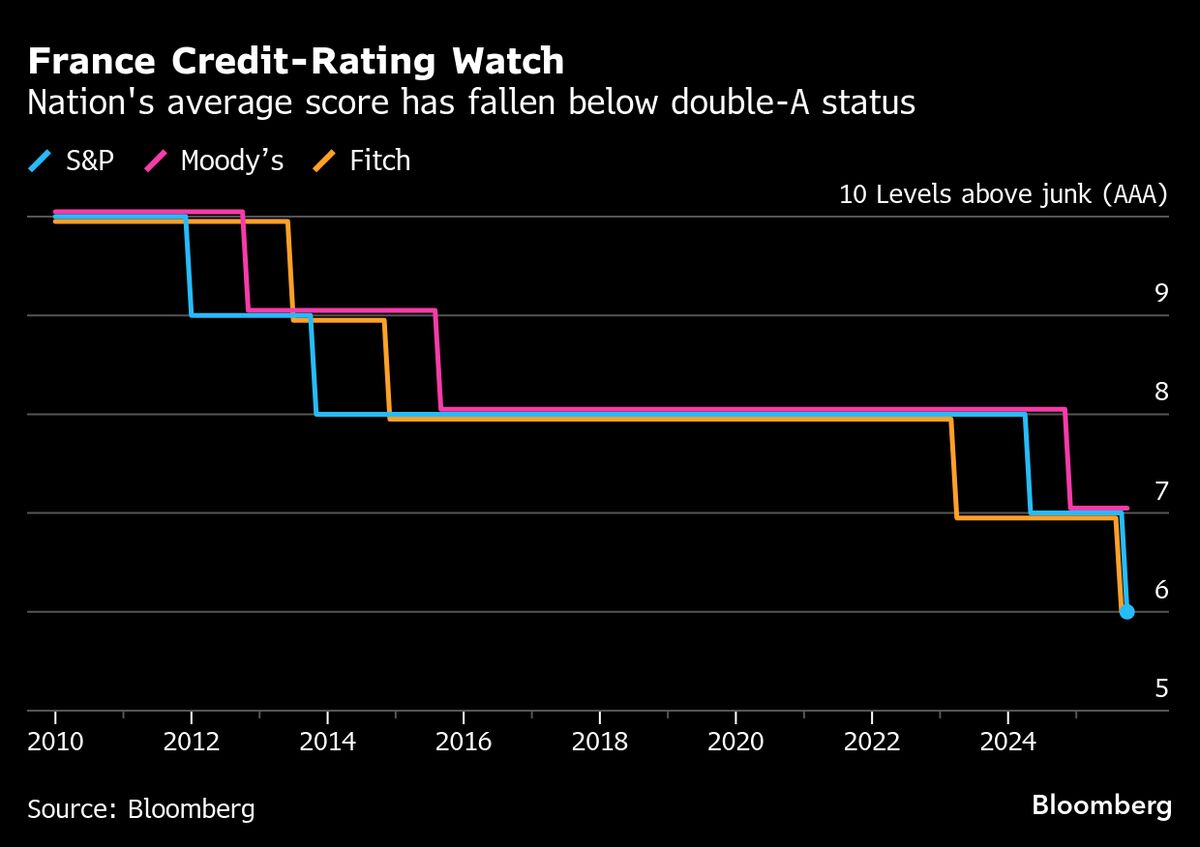

BlackRock, State Street Funds Redraw Rules to Keep French Bonds

PositiveFinancial Markets

In a strategic move, major asset managers like BlackRock and State Street are adjusting their investment rules to prevent forced sales of French bonds. This decision is significant as it reflects a proactive approach to managing risks in the bond market, ensuring stability for investors and maintaining confidence in French debt. By avoiding hasty sales, these funds are not only protecting their portfolios but also supporting the broader financial ecosystem.

— Curated by the World Pulse Now AI Editorial System