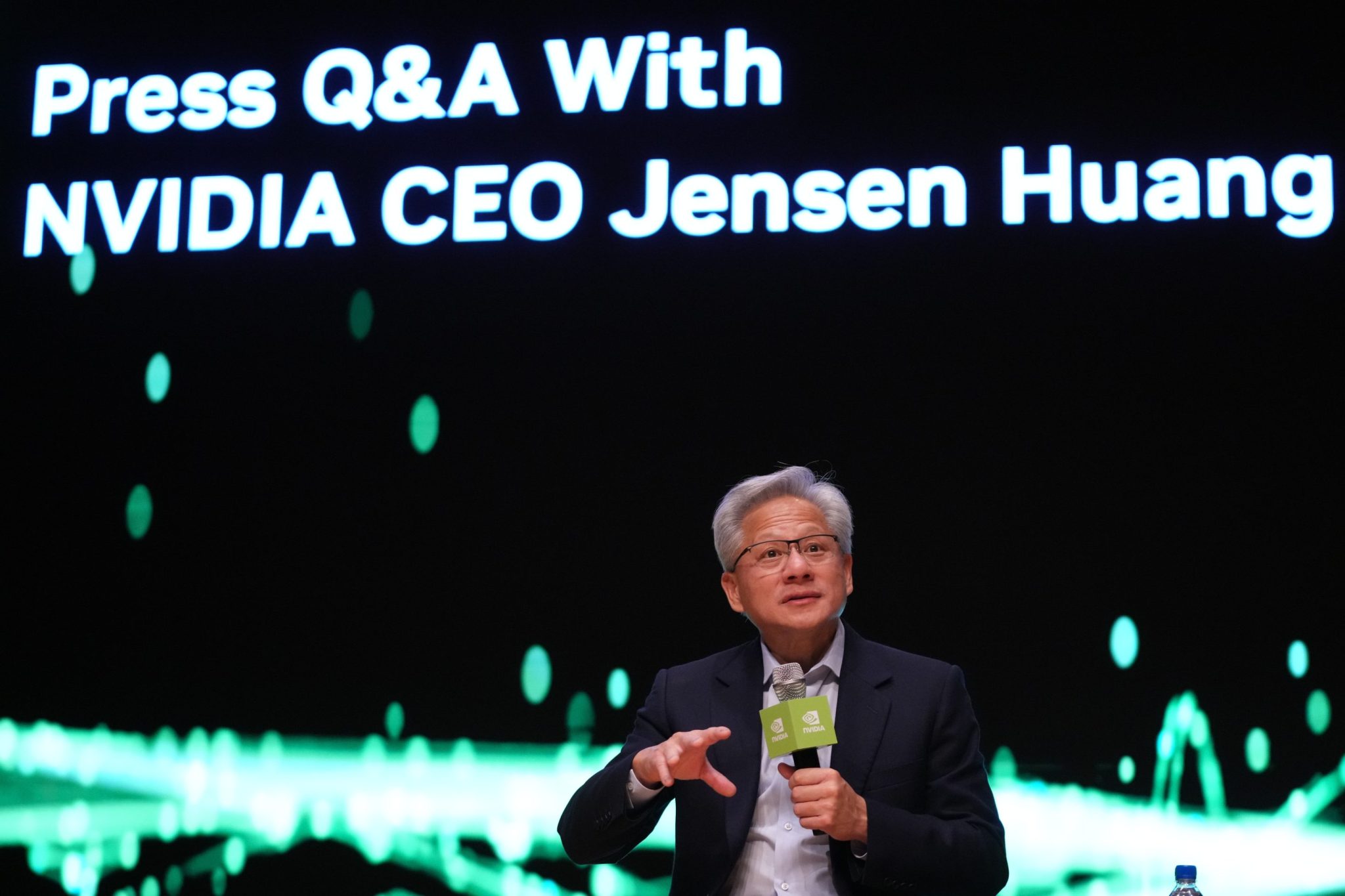

European stocks rise strongly after Nvidia’s blowout; BNP Paribas surges

PositiveFinancial Markets

- European stocks rose sharply after Nvidia reported record earnings of $57 billion, easing fears of an AI bubble and boosting investor sentiment. BNP Paribas also surged in response to the favorable market conditions.

- Nvidia's strong performance is crucial as it not only reassures investors about the sustainability of the AI boom but also enhances its market position, potentially leading to further investments and growth opportunities.

- This development highlights a broader trend of increasing confidence in technology stocks, particularly in the wake of Nvidia's results, which have positively influenced market dynamics across Europe and beyond.

— via World Pulse Now AI Editorial System