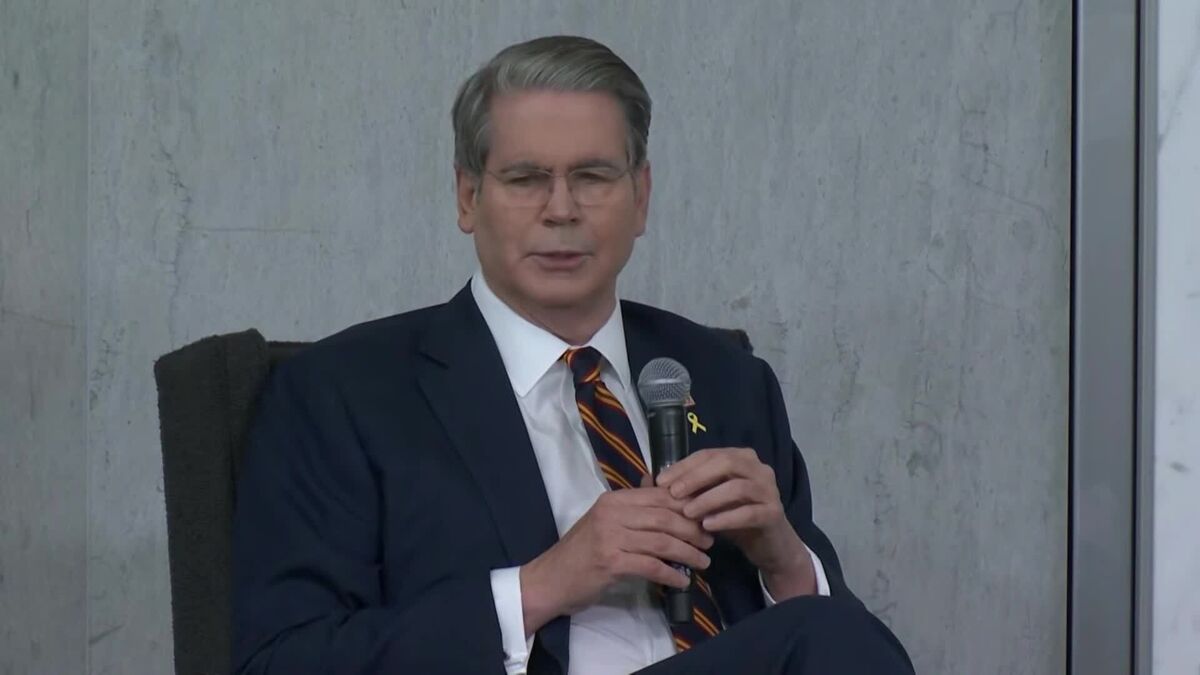

Fed’s Barr Urges Caution With Further Rate Moves, Underscoring Committee’s Divisions

NeutralFinancial Markets

Federal Reserve governor Michael Barr has emphasized the need for caution regarding future interest rate adjustments following last month's rate cut. He expressed concerns about ongoing inflation, suggesting that the central bank should carefully evaluate its next steps. This is significant as it highlights the internal divisions within the Fed and the challenges it faces in balancing economic growth with inflation control.

— Curated by the World Pulse Now AI Editorial System