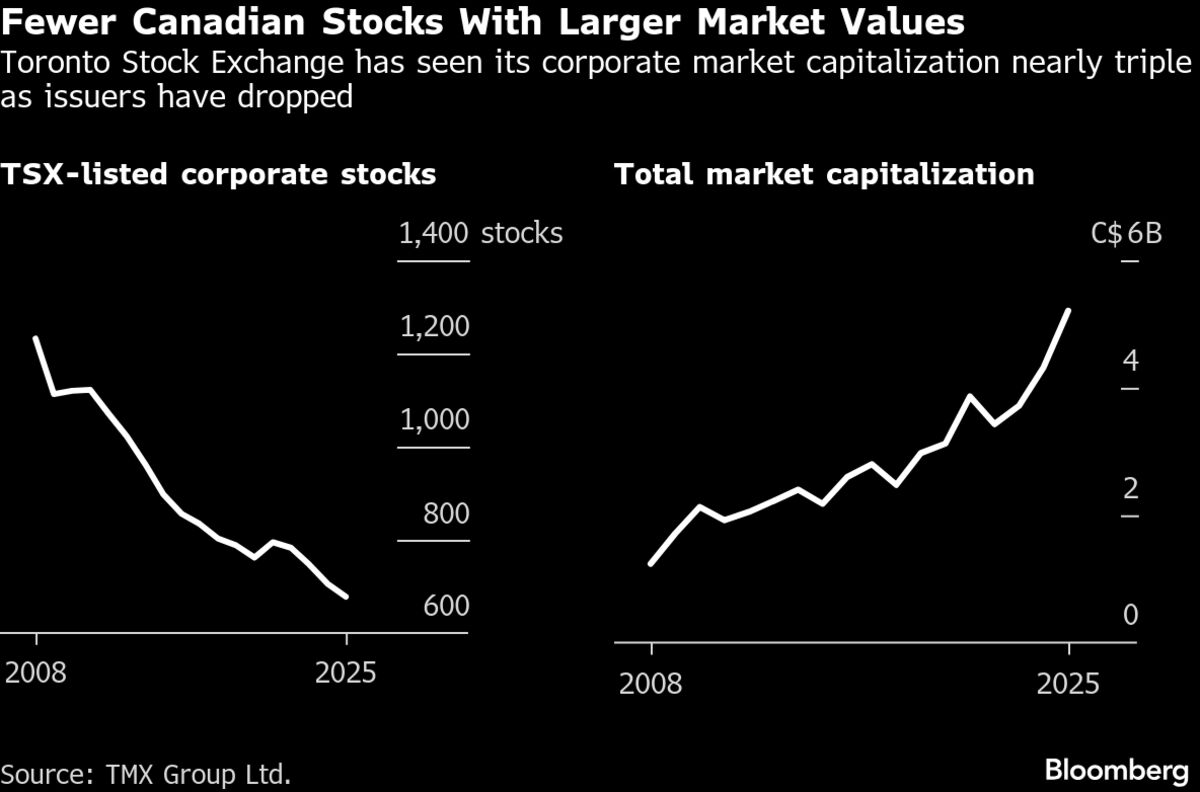

Canada Needs IPOs to Reverse a Shrinking Number of Stocks

NegativeFinancial Markets

- Canada’s stock exchanges are experiencing a decline, with the number of publicly traded companies decreasing for the fourth consecutive year, despite the S&P/TSX Composite index outperforming the S&P 500. This trend raises concerns about the vitality of the Canadian market and its ability to attract new investments.

- The shrinking number of IPOs is critical as it reflects broader economic challenges and may deter potential investors, impacting market liquidity and the overall investment climate in Canada. A robust IPO market is essential for fostering growth and innovation in the economy.

- This situation is compounded by a recent drop in foreign investment and a contraction in the services sector, indicating a fragile economic environment. While some sectors, like steel, are seeing government support, the overall trend suggests a need for strategic measures to revitalize the market and restore investor confidence.

— via World Pulse Now AI Editorial System