Mighty Ducks Actor Gave Adams $1 Million Days Prior to His Exit

NeutralFinancial Markets

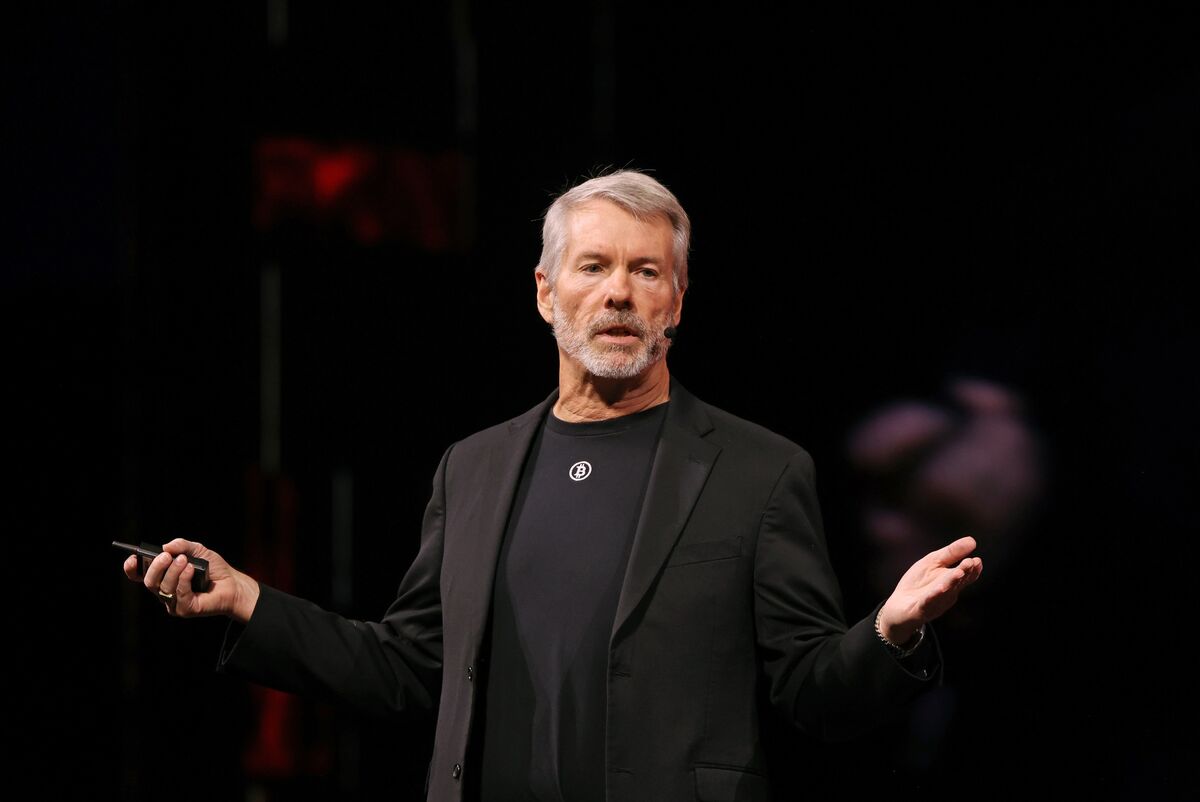

In an intriguing turn of events, Brock Pierce, a former child actor known for his role in the Mighty Ducks and now a Bitcoin investor, donated $1 million to a super-PAC supporting New York Mayor Eric Adams just five days before Adams suspended his campaign. This substantial contribution raises questions about the influence of financial backing in political races and highlights the often unpredictable nature of campaign dynamics.

— Curated by the World Pulse Now AI Editorial System