Gold’s Long-Term Drivers Remain Intact Despite Recent Correction

PositiveFinancial Markets

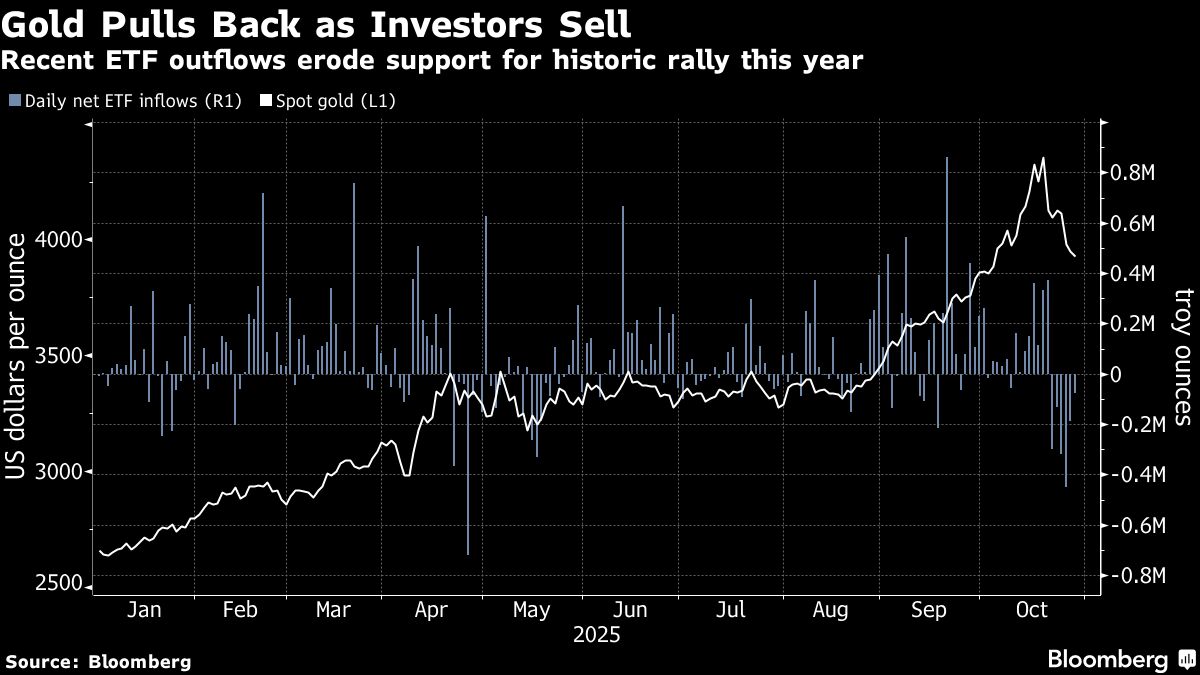

Gold prices are showing resilience as they edged higher in early Asian trading, driven by ongoing demand from central banks. This is significant because it indicates that despite recent market corrections, the long-term fundamentals supporting gold remain strong, suggesting that investors may continue to view it as a safe haven.

— Curated by the World Pulse Now AI Editorial System