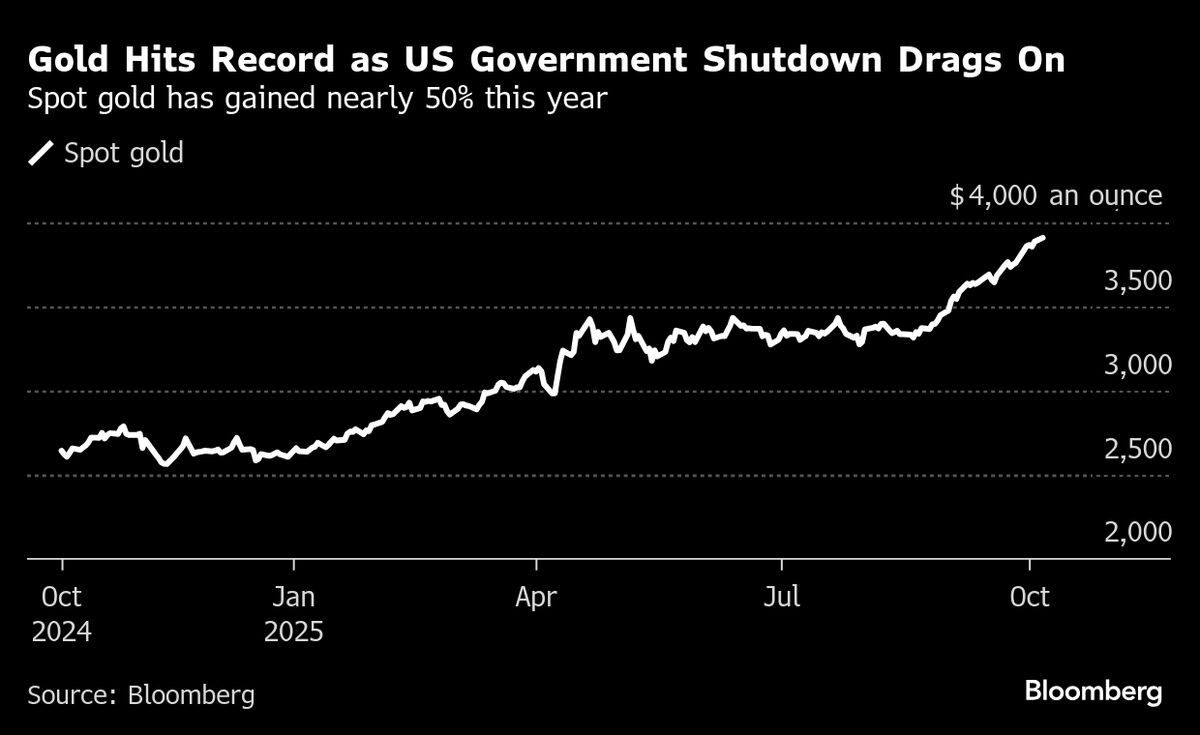

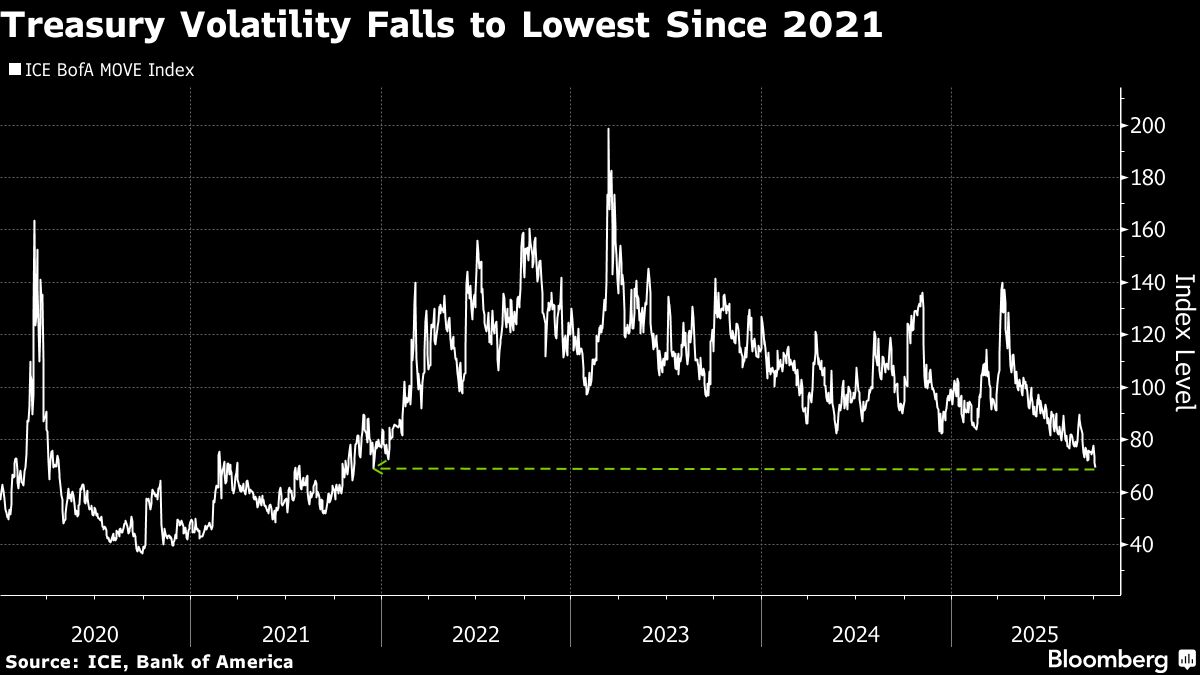

Bond Volatility Is Collapsing as US Shutdown Creates Data Void

NegativeFinancial Markets

The recent US government shutdown has led to a significant drop in expected volatility in the Treasuries market, reaching its lowest point in nearly four years. This situation arises as crucial economic data releases are delayed, leaving traders without the necessary information to make informed decisions. The lack of data creates a void that can hinder market movements, making it a critical issue for investors who rely on these indicators for trading strategies.

— Curated by the World Pulse Now AI Editorial System