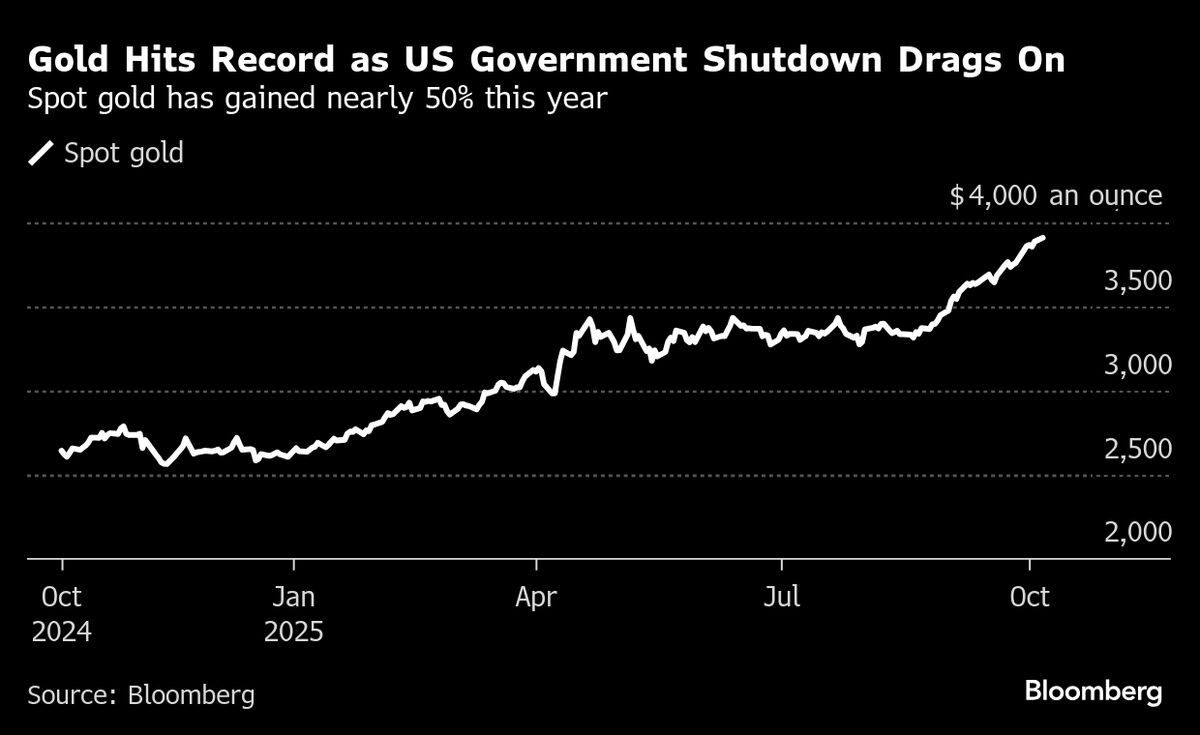

Gold Hits Another Record High as US Government Shutdown Drags On

PositiveFinancial Markets

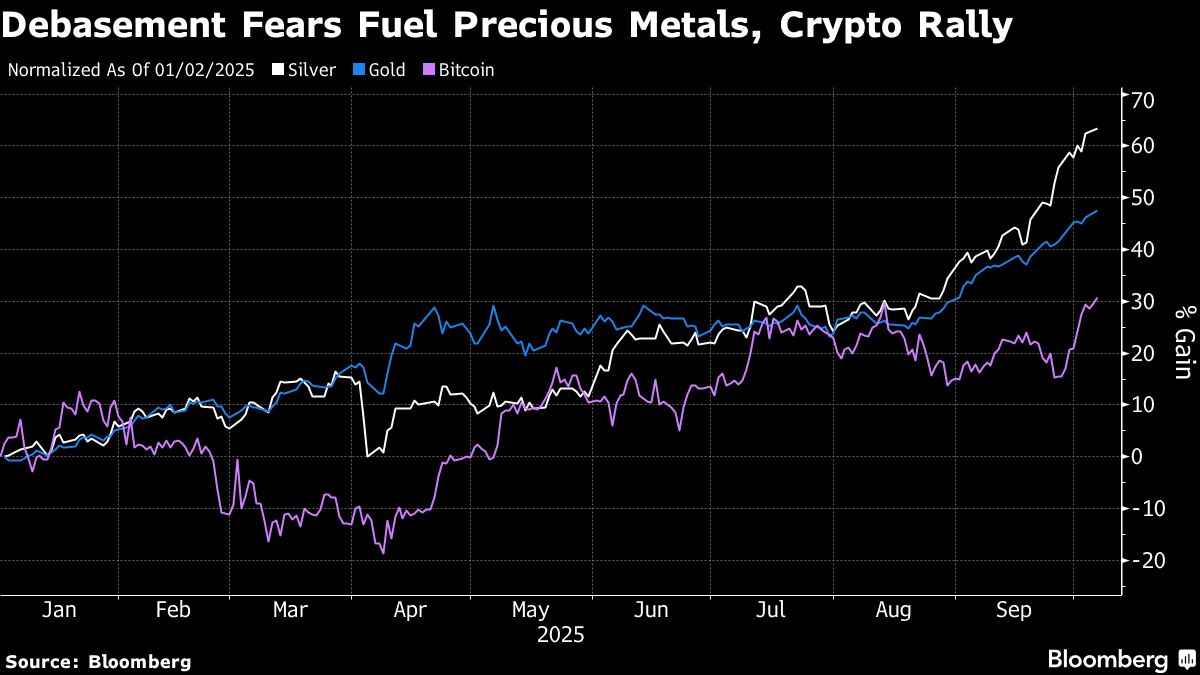

Gold prices have soared to a new record high as investors seek safe havens amid the ongoing US government shutdown. This surge reflects growing concerns about economic stability and highlights gold's role as a reliable asset during uncertain times. As the shutdown continues, many are turning to gold, which could signal a shift in market dynamics and investor sentiment.

— Curated by the World Pulse Now AI Editorial System