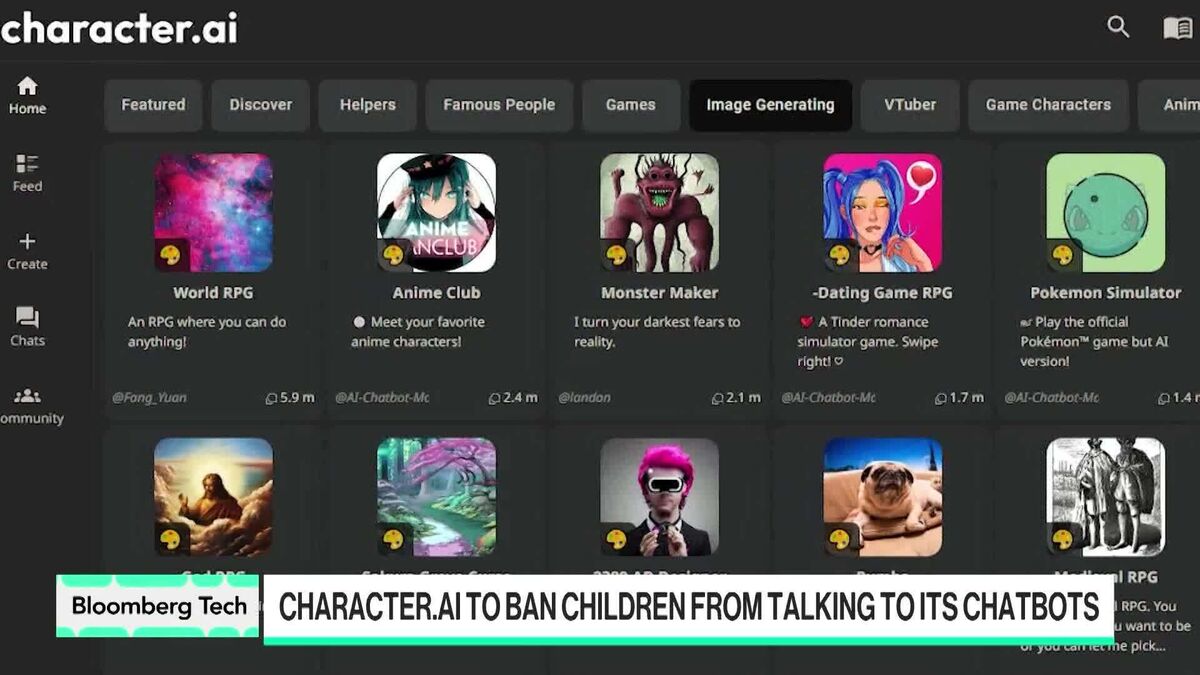

Character.AI to Ban Minors From Talking to Its Chatbots

PositiveFinancial Markets

Character.AI has decided to ban minors from interacting with its chatbots, a move that comes in response to increasing pressure from lawmakers and various lawsuits. This decision is significant as it prioritizes the safety of children online, ensuring that young users are protected from potentially harmful interactions. By taking this step, Character.AI is setting a precedent in the tech industry, highlighting the importance of responsible AI usage.

— Curated by the World Pulse Now AI Editorial System