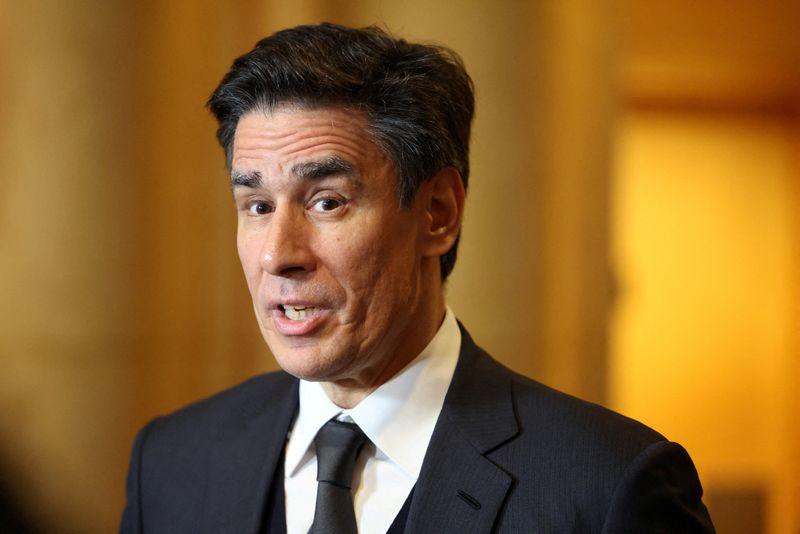

Nestle chairman to step down early after CEO ouster

NegativeFinancial Markets

Nestle's chairman will resign earlier than expected following the recent ousting of the CEO. This leadership change raises concerns about the company's stability and future direction.

Editor’s Note: This matters because leadership transitions can significantly impact a company's performance and investor confidence. The abrupt change at Nestle may lead to uncertainty in its strategic plans and market position.

— Curated by the World Pulse Now AI Editorial System