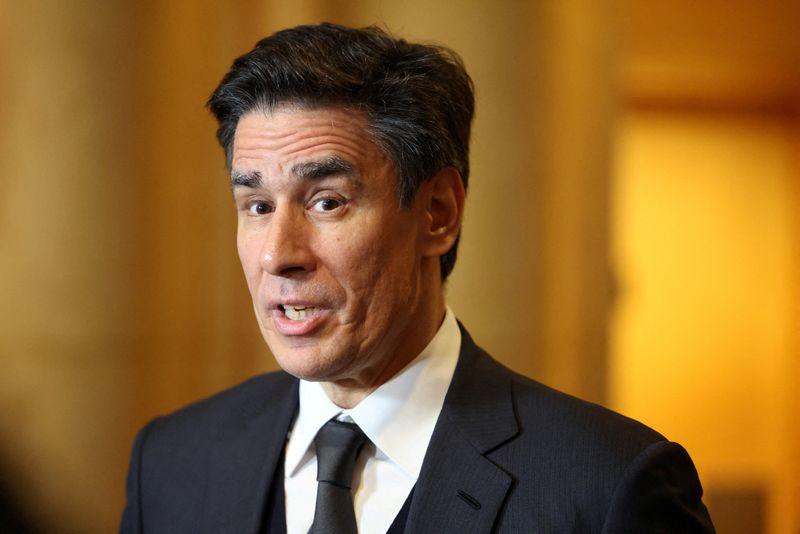

Agnico Isn’t Considering a Bid for Teck Resources, CEO Says

NeutralFinancial Markets

Agnico Eagle Mines Ltd. has no plans to acquire Teck Resources Ltd., as stated by its CEO.

Editor’s Note: This clarification is important for investors and stakeholders in the mining sector, as it impacts market expectations and potential future mergers.

— Curated by the World Pulse Now AI Editorial System