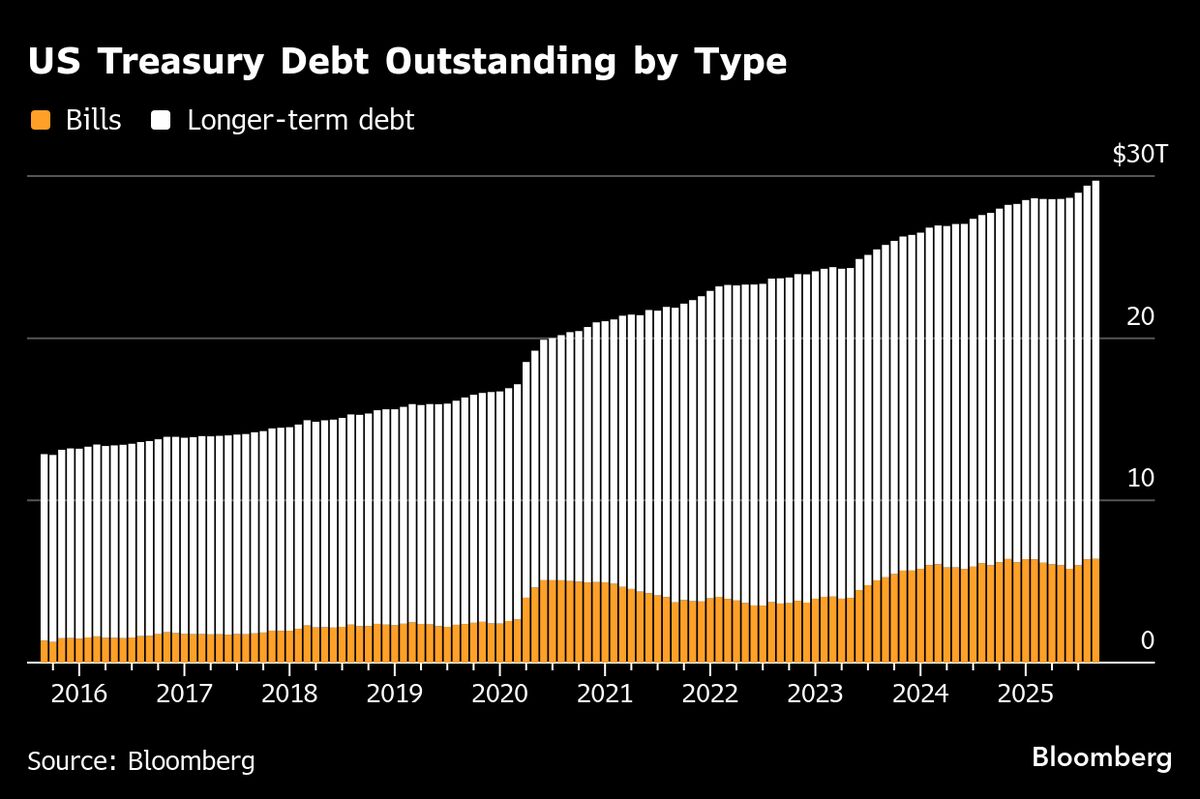

Bank of America Sees US Bill Supply Boost Curbing 10-Year Yield

PositiveFinancial Markets

Bank of America has reported that a likely shift by the US Treasury Department towards short-term bills for deficit financing could lead to a significant drop in 10-year note yields, potentially by over a quarter point. This is important as lower yields can stimulate borrowing and investment, positively impacting the economy.

— Curated by the World Pulse Now AI Editorial System