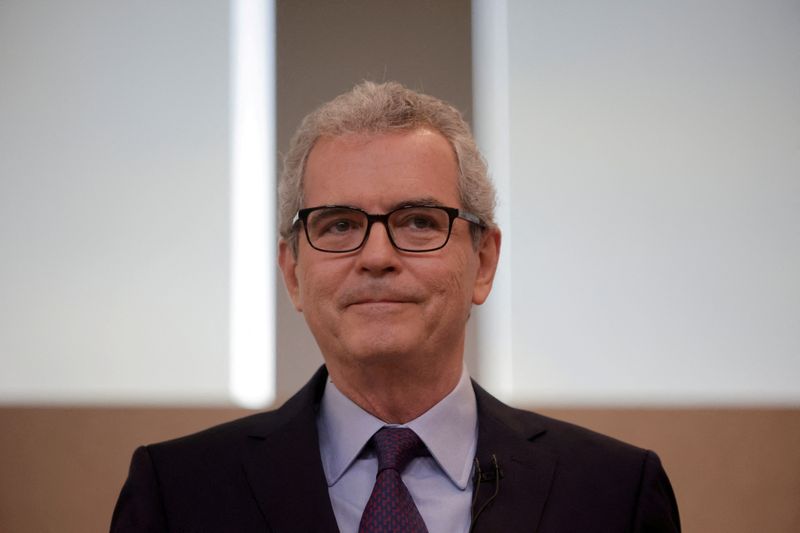

Nestle’s new chairman Isla brings Zara magic to Nescafe maker’s turnaround

PositiveFinancial Markets

Nestle's new chairman, Mark Isla, is bringing a fresh perspective to the company, drawing inspiration from his successful tenure at Zara. His innovative approach is expected to revitalize Nestle's brand and boost its performance, particularly for iconic products like Nescafe. This leadership change is significant as it signals a commitment to transformation and growth in a competitive market.

— Curated by the World Pulse Now AI Editorial System