ASML stock maintains Market Perform rating at Bernstein amid X-ray lithography startup claims

NeutralFinancial Markets

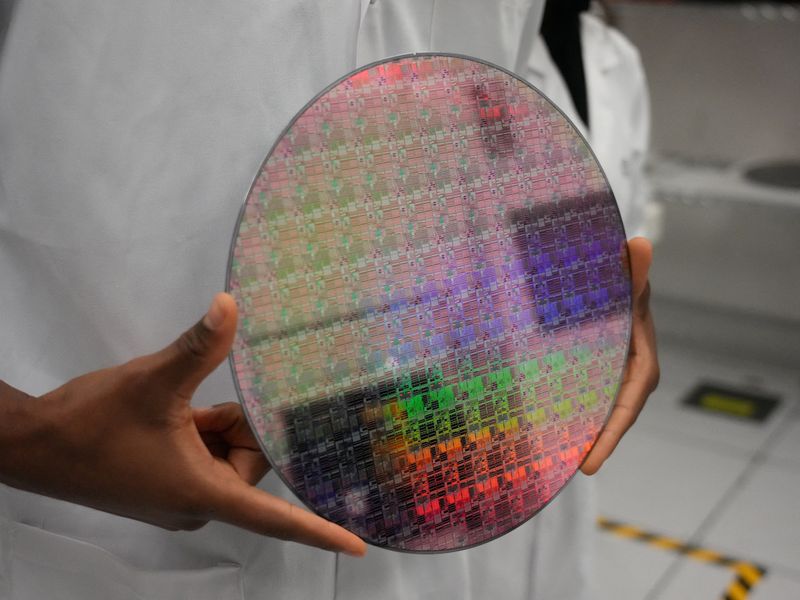

ASML's stock has retained a Market Perform rating from Bernstein, despite recent claims regarding the startup of X-ray lithography technology. This is significant as it reflects investor sentiment and market expectations surrounding ASML's innovations and their potential impact on the semiconductor industry.

— Curated by the World Pulse Now AI Editorial System