Can a Start-Up Make Computer Chips Cheaper Than the Industry’s Giants?

PositiveFinancial Markets

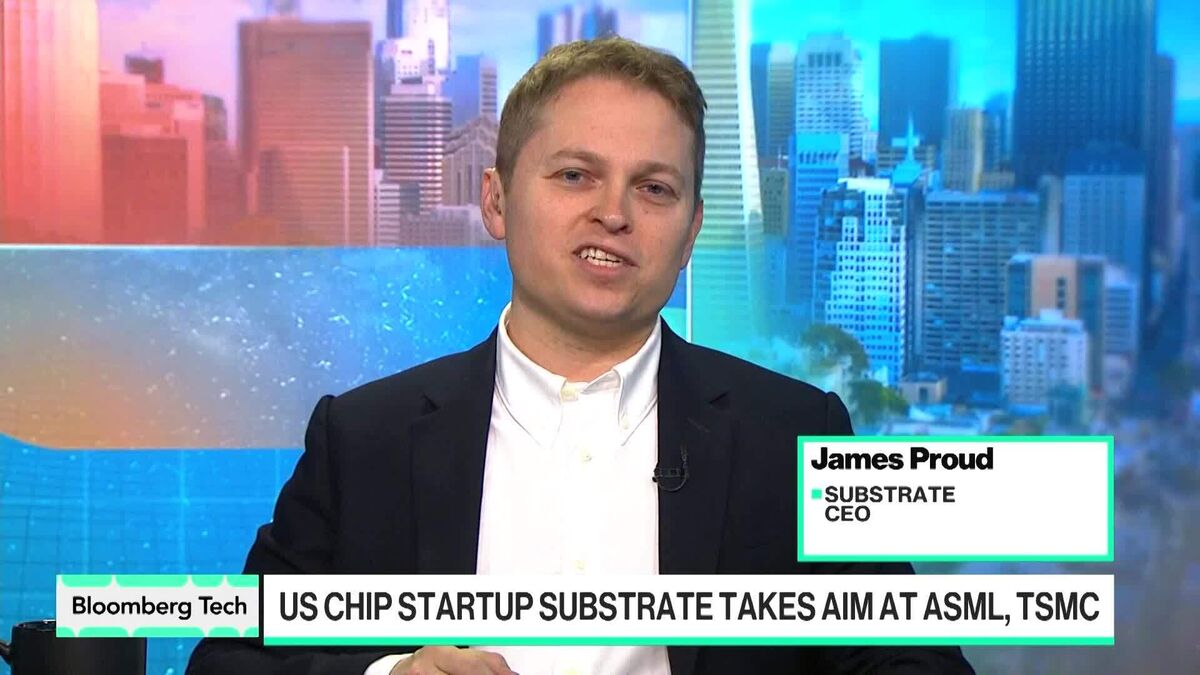

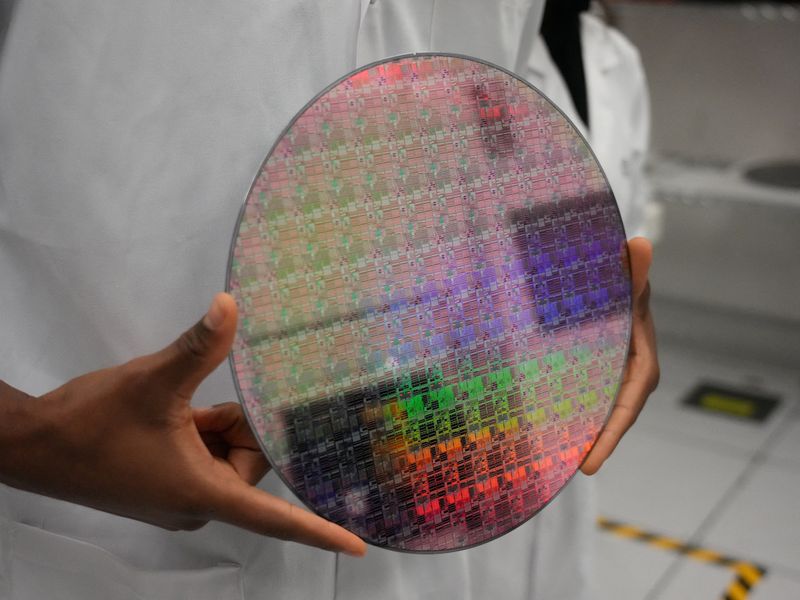

Substrate, a promising start-up based in San Francisco, is making waves in the tech industry by aiming to produce computer chips at a lower cost than established giants like ASML. This innovation could significantly impact the semiconductor market, making advanced technology more accessible and potentially driving down prices for consumers. As the demand for chips continues to grow, Substrate's efforts could reshape the competitive landscape and encourage further advancements in chip manufacturing.

— Curated by the World Pulse Now AI Editorial System