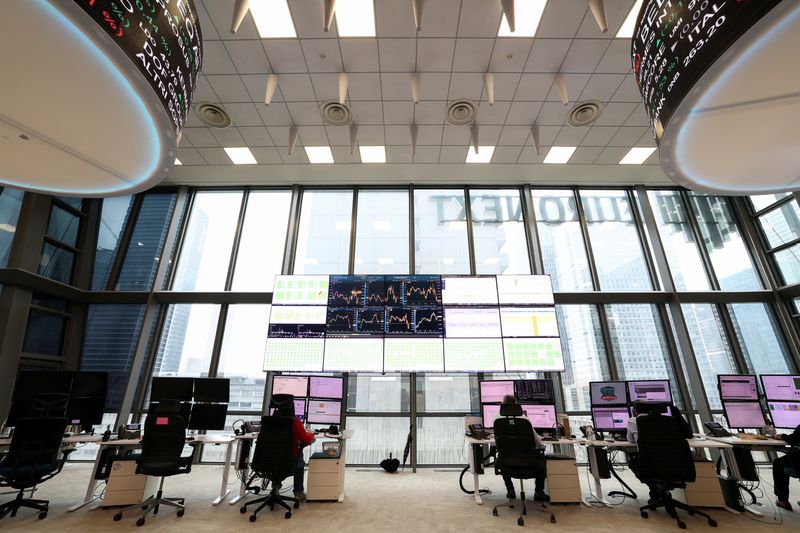

European fund flows accelerate as investors shift to large-cap equities

PositiveFinancial Markets

European fund flows are on the rise as investors increasingly turn their attention to large-cap equities. This shift indicates a growing confidence in the stability and potential of larger companies, which could lead to more robust market performance. As investors seek safer and more reliable options, this trend highlights a strategic move towards established firms that are likely to weather economic fluctuations better than smaller counterparts.

— Curated by the World Pulse Now AI Editorial System