‘Hedge America’ Trade Fuels Global Rush Into Short-Dollar Wagers

PositiveFinancial Markets

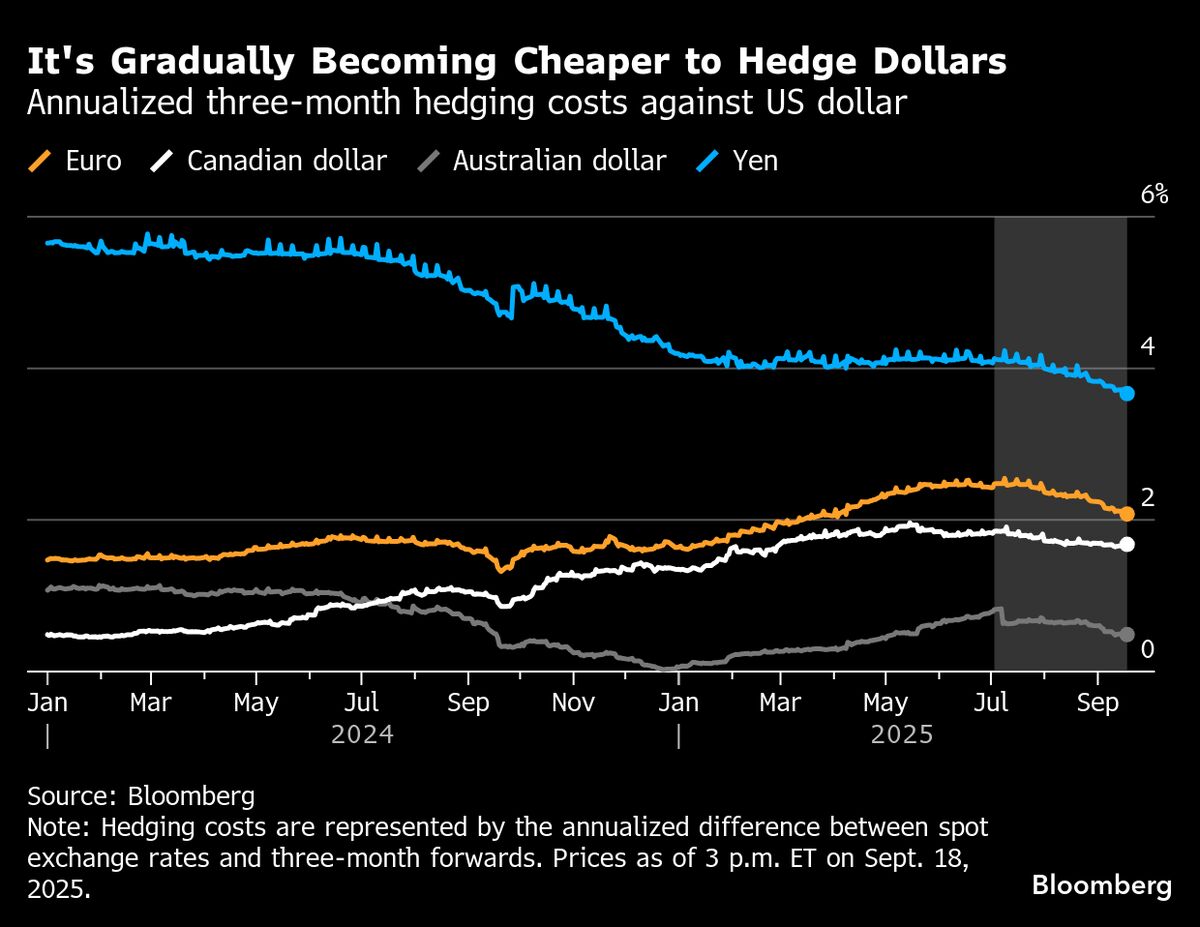

The recent trend of 'Hedge America' has sparked a global interest in short-dollar investments, countering earlier fears about the U.S. economy. This shift indicates a growing confidence among investors, suggesting that the initial concerns about a downturn were overblown. As markets adapt to this new strategy, it highlights the resilience of the financial landscape and the potential for profitable opportunities.

— Curated by the World Pulse Now AI Editorial System