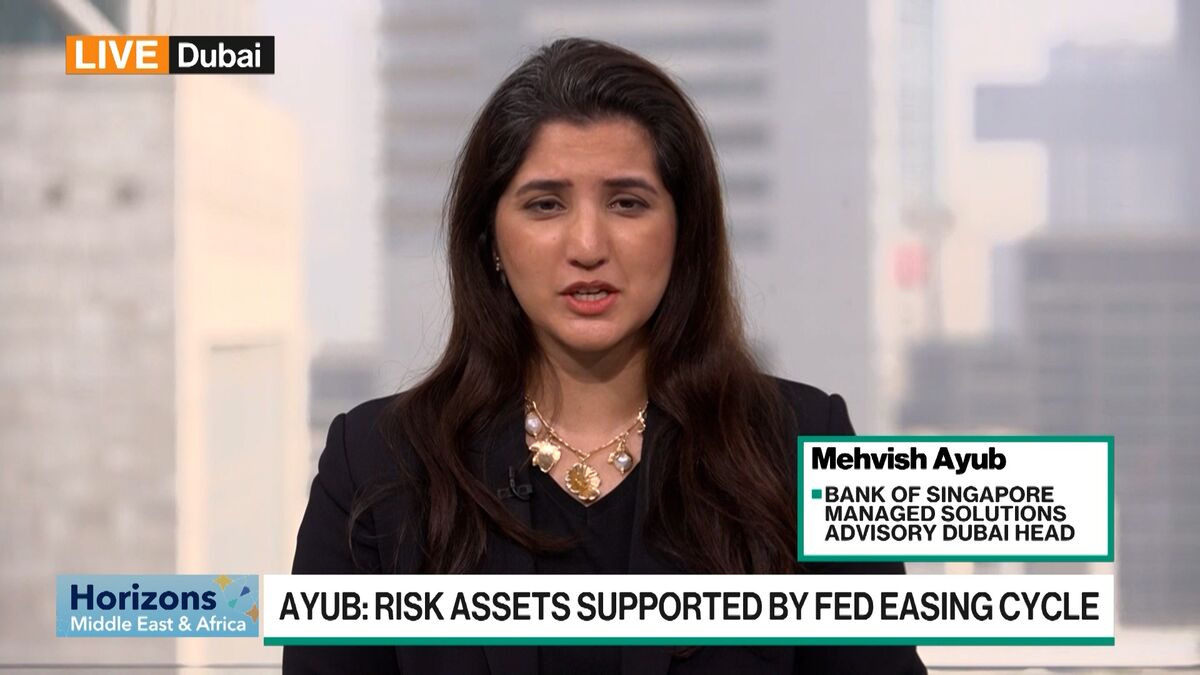

Ayub: Risk Assets Supported by Fed Easing Cycle

PositiveFinancial Markets

- Growing expectations for an interest rate cut by the Federal Reserve have led to a significant uptick in global equities, marking the best week for markets since June. Mehvish Ayub from the Bank of Singapore noted that optimism surrounding Fed easing and advancements in AI are influencing market sentiment, potentially leading to future volatility.

- This development is crucial for investors and financial institutions as it reflects a shift in monetary policy that could lower borrowing costs, thereby stimulating economic activity and investment in risk assets.

- The current market dynamics underscore a broader trend of fluctuating investor sentiment influenced by central bank policies, with many anticipating further rate cuts. This optimism is particularly evident in the technology sector, which has seen substantial gains, highlighting the interconnectedness of monetary policy and sector performance.

— via World Pulse Now AI Editorial System