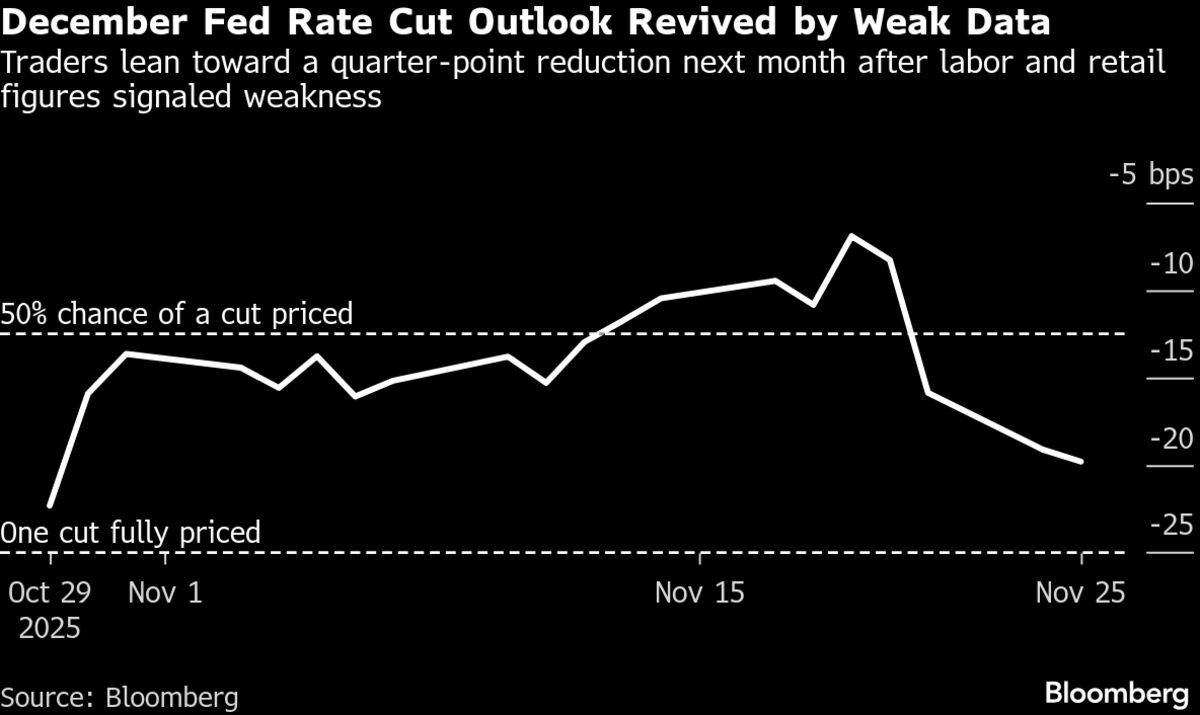

Traders Crowd Into Fed Futures Targeting a December Rate Cut

PositiveFinancial Markets

- Investors are increasingly betting on a Federal Reserve interest rate cut in December, following a shift in sentiment that has emerged over the past week. This change is reflected in the surge of activity in Fed futures, indicating a strong belief that policymakers will act to lower borrowing costs during their upcoming meeting.

- The anticipation of a rate cut is significant for US bonds, as it could lead to price gains and a favorable environment for investors. The market's reaction suggests a growing confidence in the Fed's ability to manage economic conditions effectively.

- This development aligns with recent comments from key Fed officials, including New York Fed President John Williams, who indicated potential for further adjustments in borrowing costs. Additionally, broader market trends show a rebound in US stocks and a rise in the dollar, reflecting optimism about the Fed's monetary policy direction amid mixed economic signals.

— via World Pulse Now AI Editorial System