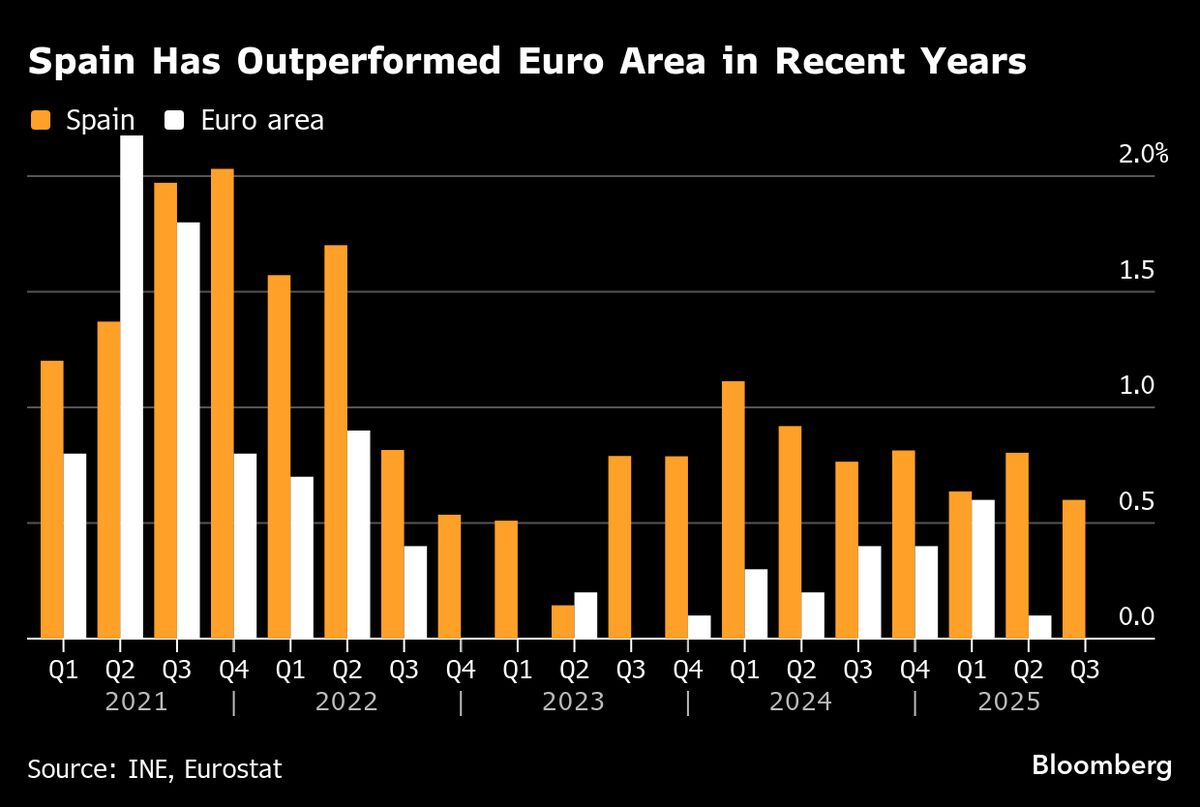

Spain's economic growth gently decelerates in third quarter

NeutralFinancial Markets

Spain's economic growth has shown signs of gentle deceleration in the third quarter, reflecting broader trends in the European economy. This slowdown is significant as it may impact employment rates and consumer confidence, prompting discussions on potential policy adjustments. Understanding these shifts is crucial for businesses and investors as they navigate the changing economic landscape.

— Curated by the World Pulse Now AI Editorial System