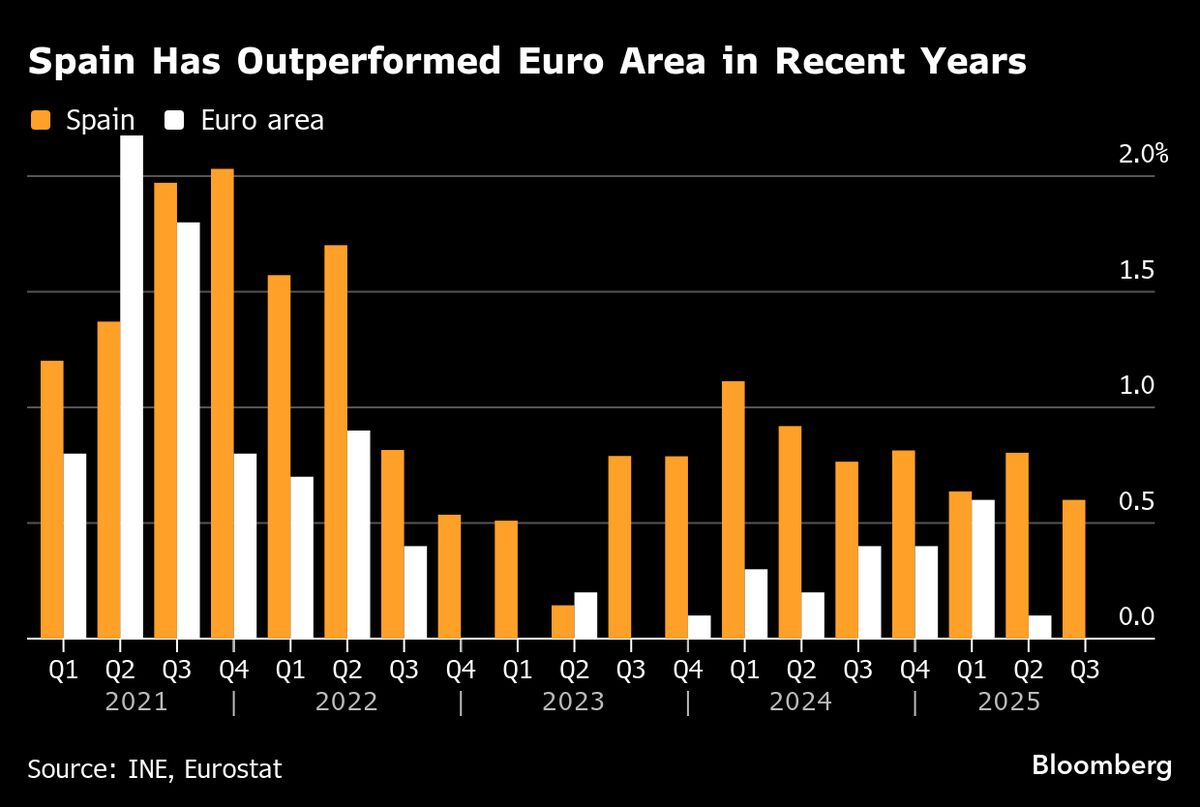

Spain’s Economic Outperformance Slows

NeutralFinancial Markets

Spain's economy is showing signs of slowing down as robust household spending and solid employment trends are being overshadowed by a decline in exports. This shift is significant as it highlights the challenges the country faces amid ongoing geopolitical uncertainties, which could impact future growth and stability.

— Curated by the World Pulse Now AI Editorial System