Fed’s T-bill pivot expected to ease supply, but rate futures flag tight funding

NeutralFinancial Markets

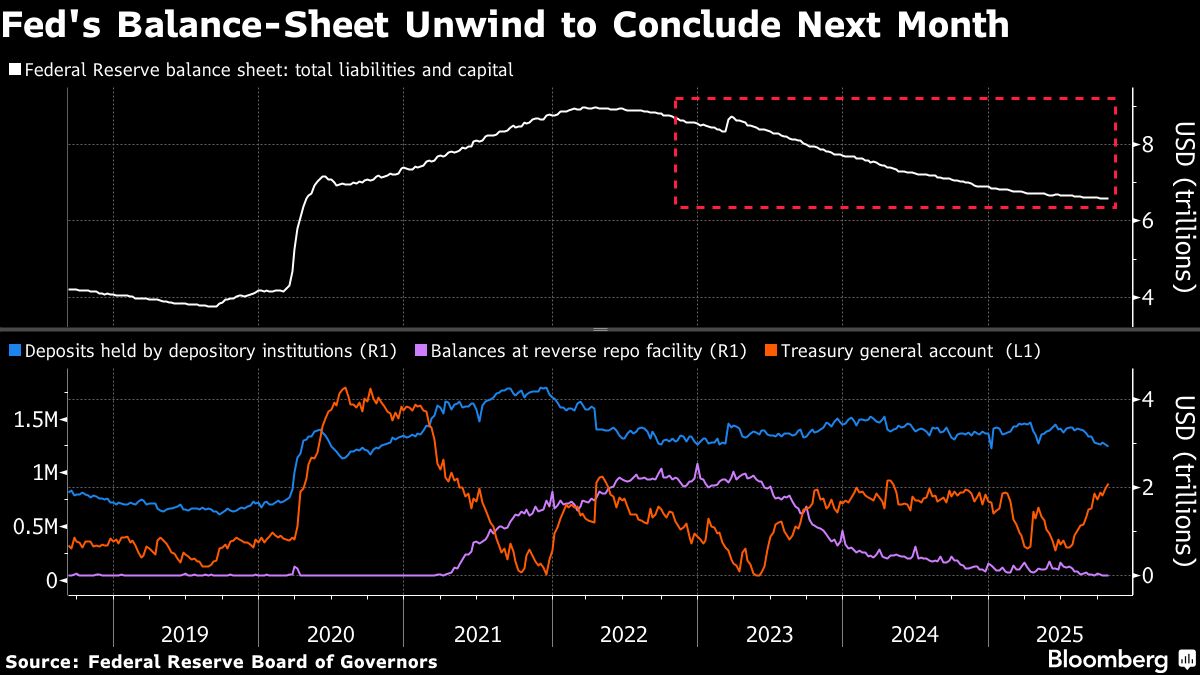

The Federal Reserve's recent shift regarding Treasury bills is anticipated to alleviate supply issues in the market. However, the current state of rate futures indicates that funding conditions may remain tight. This development is significant as it reflects the Fed's ongoing adjustments to monetary policy, which can impact interest rates and overall economic stability.

— Curated by the World Pulse Now AI Editorial System