BlackRock exec drops hot take on economy

PositiveFinancial Markets

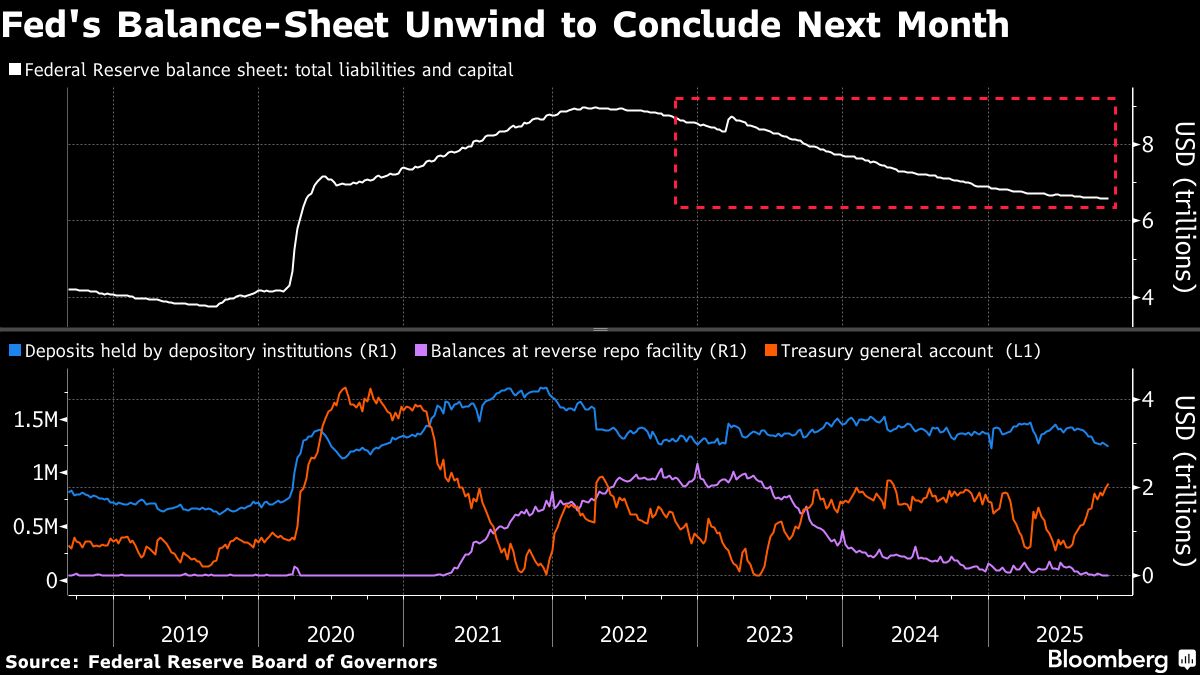

In a recent interview with Yahoo Finance, BlackRock's Rick Rieder shared his optimistic outlook on the economy, predicting that the Federal Reserve will cut interest rates as early as December. His insights have sparked interest and discussion on Wall Street, highlighting the potential for a shift in monetary policy sooner than many anticipated.

— Curated by the World Pulse Now AI Editorial System