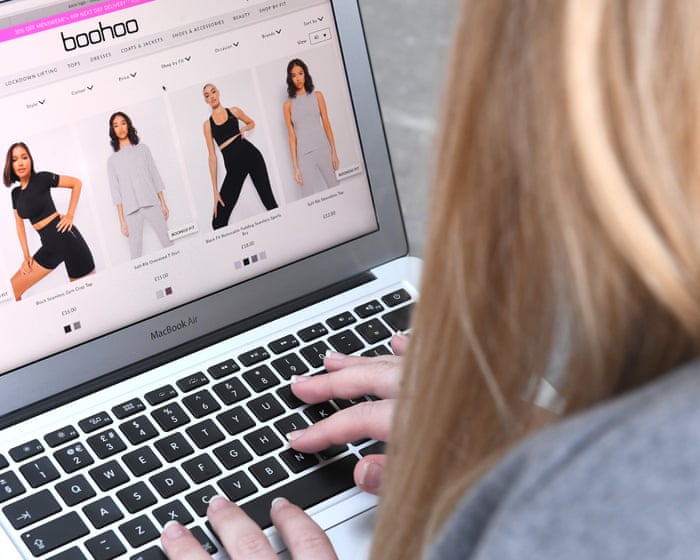

Boohoo Shares Jump as All Brands Return to Profit, Earnings Seen Higher

PositiveFinancial Markets

- Boohoo's shares surged as the company announced that all its brands have returned to profitability, projecting an EBITDA of £45 million for fiscal 2026, with expectations for double-digit growth in the following year. This marks a significant turnaround for the retailer, which has faced challenges in recent years.

- The positive earnings outlook is crucial for Boohoo as it signals a recovery in its business operations, potentially restoring investor confidence and enhancing its market position. The narrowing of losses to £3.4 million further supports this optimistic trajectory.

- This development occurs amid a mixed retail landscape, where some companies like Kohl's and Gap are also reporting positive financial results, while others, such as Target and Bath & Body Works, are struggling with declining sales and revised profit forecasts. This contrast highlights the volatility in the retail sector, influenced by changing consumer behaviors and economic conditions.

— via World Pulse Now AI Editorial System