Goldman Strategists Turn Bullish on Stocks as Recession Risk Low

PositiveFinancial Markets

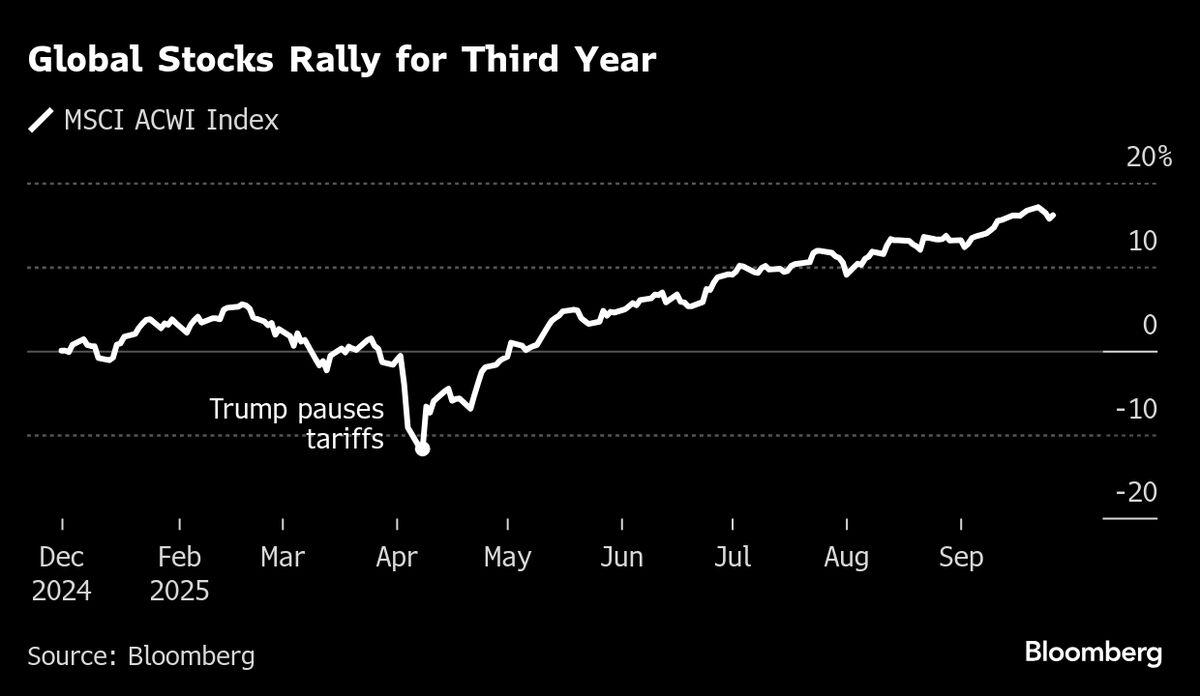

Goldman Sachs strategists are optimistic about the stock market, predicting that global equities will continue to rally as we approach the end of the year. They cite a strong US economy, favorable valuations, and a shift towards a more dovish stance from the Federal Reserve as key factors driving this positive outlook. This is significant because it suggests that investors may find more opportunities in the market, potentially leading to increased confidence and investment.

— Curated by the World Pulse Now AI Editorial System