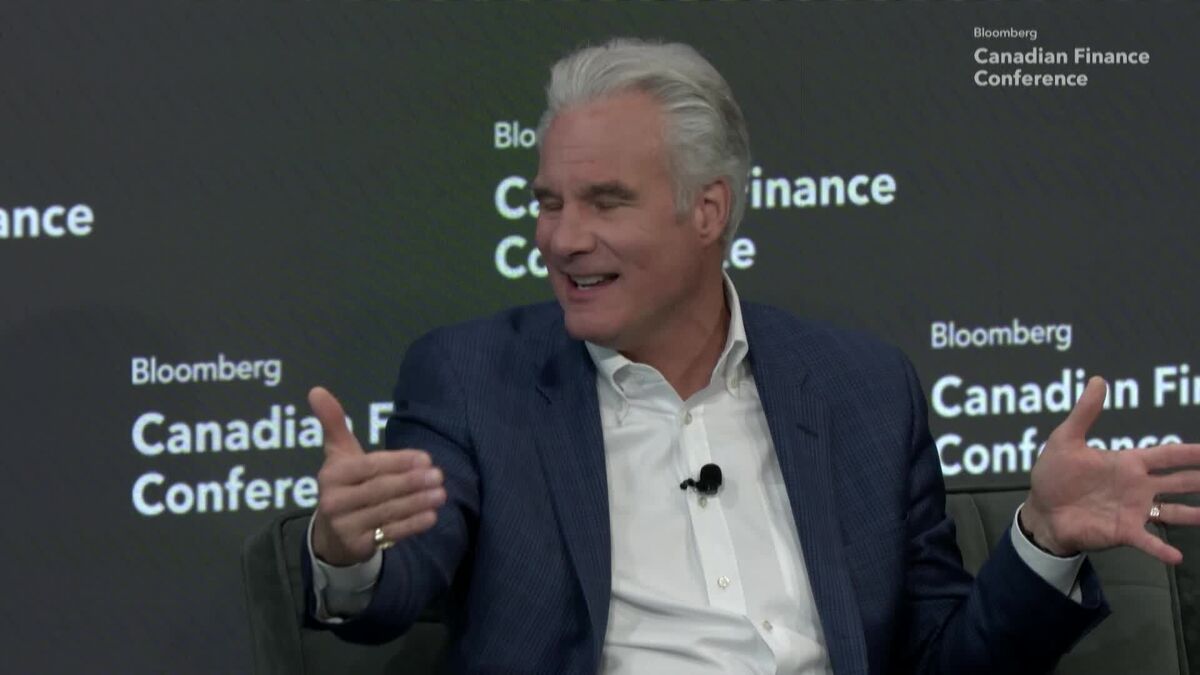

OPG, Northland Power on Canada's Energy Outlook

PositiveFinancial Markets

At the 2025 Bloomberg Canadian Finance Conference in New York, Aida Cipolla from Ontario Power Generation and David Timm from Northland Power shared insights on Canada's potential to lead in the global energy sector. Their discussion highlights the importance of Canada's role in shaping sustainable energy solutions, which is crucial for addressing climate change and energy demands worldwide.

— Curated by the World Pulse Now AI Editorial System