Emerging-Market Currencies Gain as Traders See Rate Cuts Ahead

PositiveFinancial Markets

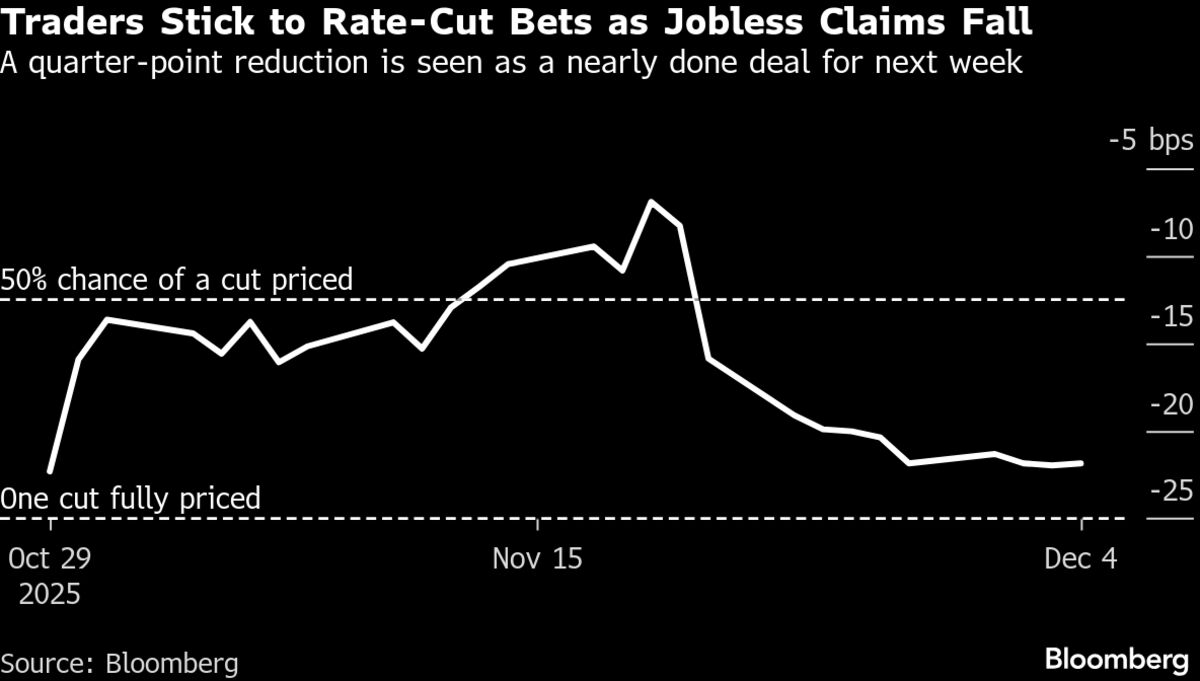

- A gauge for emerging-market currencies increased as traders reacted positively to expectations of a Federal Reserve interest-rate cut, following recent jobs data indicating a weakening labor market. This shift reflects a growing sentiment among investors regarding potential monetary easing.

- The anticipated rate cuts from the Federal Reserve are significant for emerging-market currencies, as they often benefit from lower interest rates in the U.S., which can lead to increased capital inflows and improved investor confidence in riskier assets.

- This development highlights a broader trend where fluctuations in U.S. monetary policy significantly impact global markets, particularly emerging economies, which are sensitive to changes in investor sentiment and risk appetite amid ongoing geopolitical uncertainties.

— via World Pulse Now AI Editorial System