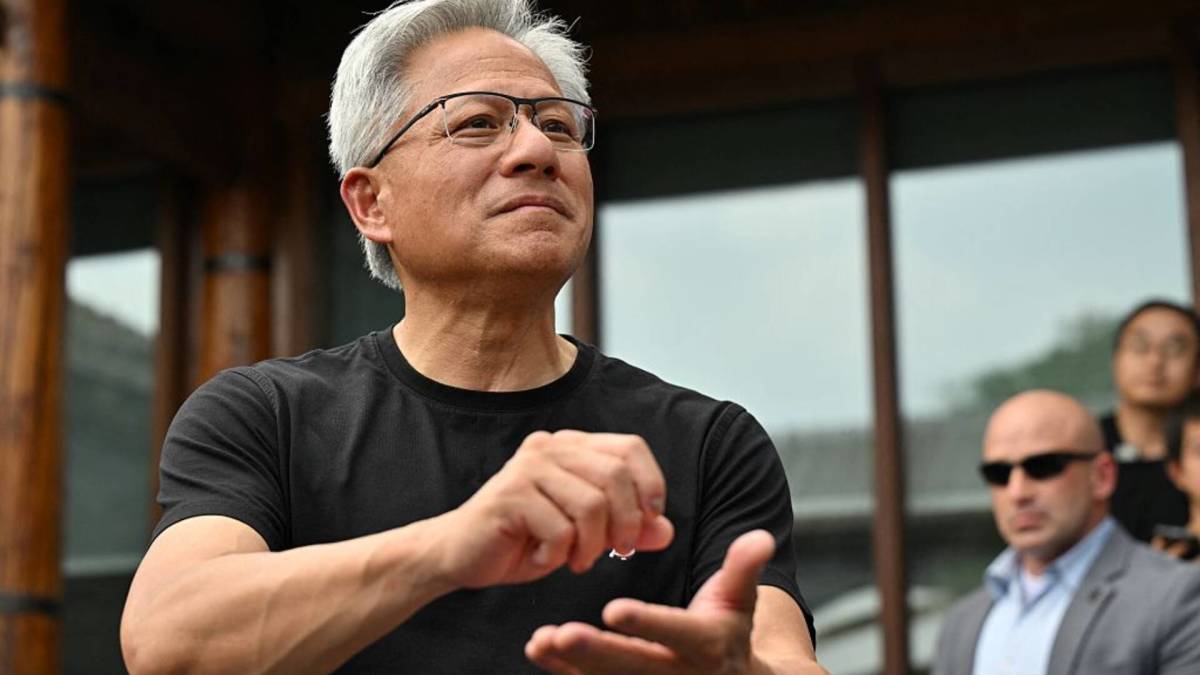

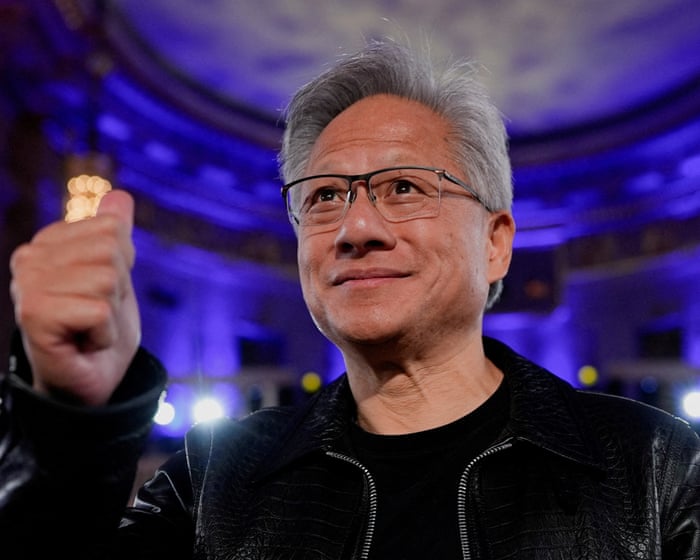

Nvidia shares drop, China tech surges as Beijing tries to push homegrown AI chips

NegativeFinancial Markets

Nvidia's shares have taken a hit as China's top internet regulator pushes local tech firms to abandon Nvidia's chips in favor of homegrown alternatives. This move highlights China's ambition to strengthen its own AI chip industry and reduce reliance on foreign technology, which could have significant implications for Nvidia's market position and the global tech landscape.

— Curated by the World Pulse Now AI Editorial System