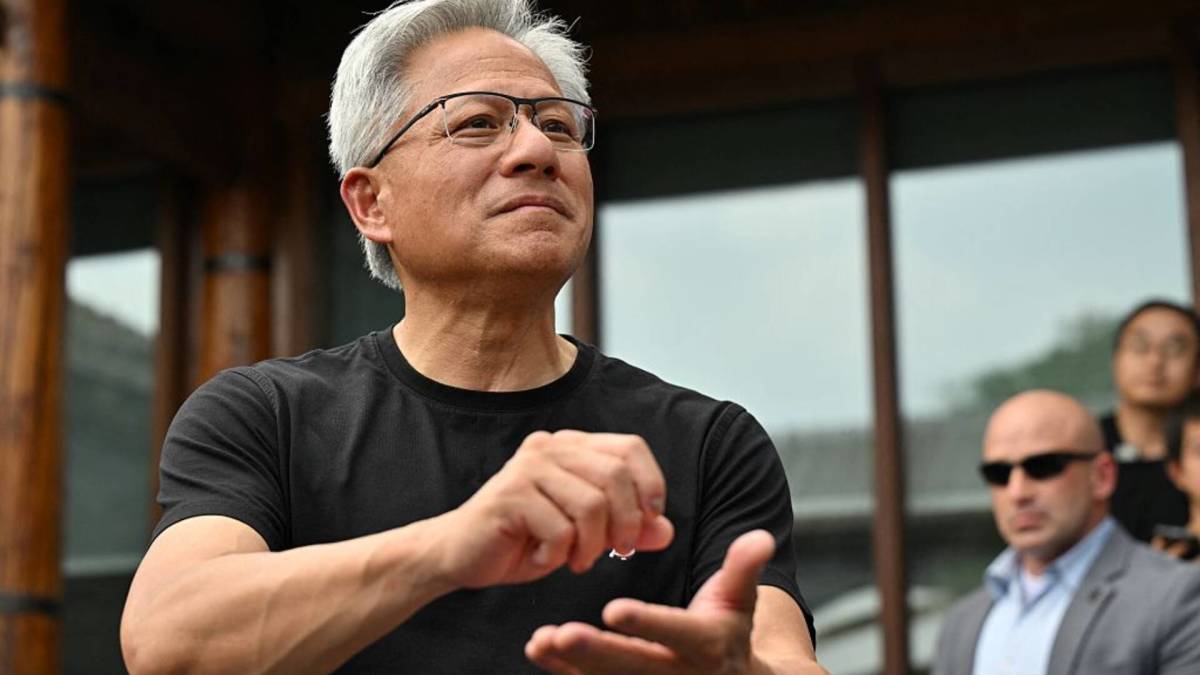

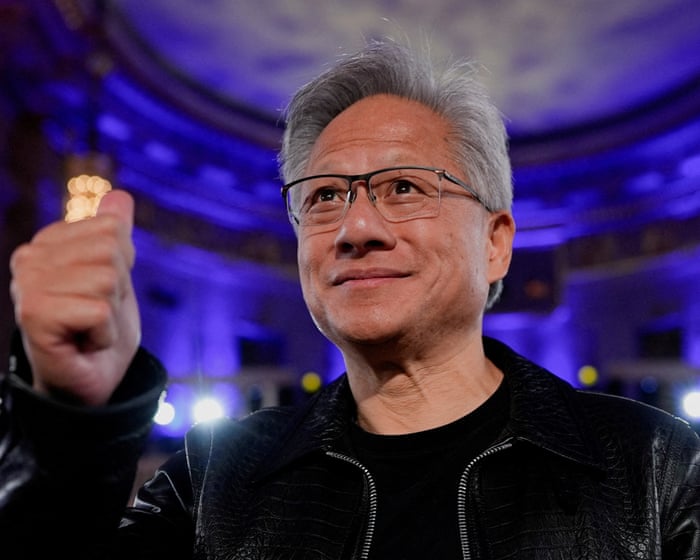

China tells tech firms to stop buying Nvidia’s AI chips, FT reports

NegativeFinancial Markets

China has reportedly instructed its tech firms to halt purchases of Nvidia's AI chips, a move that could significantly impact the global tech landscape. This decision reflects ongoing tensions between the U.S. and China over technology and trade, and it underscores China's efforts to bolster its own semiconductor industry while limiting reliance on foreign technology. The implications of this directive could ripple through the AI sector, affecting innovation and competition.

— Curated by the World Pulse Now AI Editorial System