Merz Urged by Bundesbank Chief to Speed Up Reforms for Economy

PositiveFinancial Markets

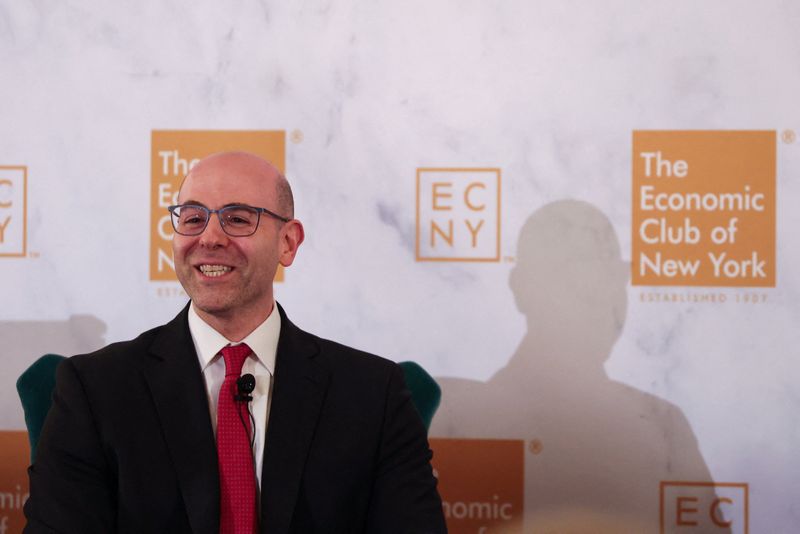

Bundesbank President Joachim Nagel is calling on Germany's government to accelerate reforms aimed at addressing the country's economic challenges. This push for reform is crucial as it seeks to enhance Germany's growth potential and tackle long-standing issues within the economy. By prioritizing these changes, the government can foster a more robust economic environment, which is essential for the nation's future prosperity.

— Curated by the World Pulse Now AI Editorial System